RealTime CEO is driven by the concept of “SON Communication” (Strategic Operational Numeric). The Crystal Ball is a tool to assess the numeric part of this process. This should always occur after the strategic issues have been considered.

The Crystal Ball is a decision validation tool and allows you to model the impact of future change.

Before entering any predictions into the Crystal Ball, determine and write down which of the 8 RealTime CEO levers will be impacted by the decision, and what the impact might be. We recognise that the future is uncertain and that prediction is not a perfect science. Instead, we suggest you assess likely ranges of change and then use the tool to assess if that possible change will make the business stronger or weaker.

The 8 levers are represented as the following possible modeling scenarios:

| Lever | Description | Modeled in | Question |

| Price | Price per unit | Percentages | Are you considering a price change? |

| Volume | Number of units | Percentages | Will you sell more or less units? |

| Direct Costs – Wages | Wage costs directly associated with the sale of units | Hundreds of thousands | Will direct wage costs change based on the decision? |

| Direct Costs – Other | Material and non-wage costs directly associated with the sale of units | Hundreds of thousands | Will other direct costs change based on the decision? How will costs behave if the business changes size?

Note that for the Direct Costs Other and Indirect Costs Other levers, the increase will exclude depreciation because a volume increase will not increase depreciation. |

| Indirect Costs – Wages | Wage costs not directly associated with the sale of units | Hundreds of thousands | Will Indirect Wages change based on the decision?

|

| Indirect Costs – Other | Costs not directly associated with the sale of units | Hundreds of thousands | Will other Indirect costs change based on the decision?

|

| AR Days | How quickly is revenue collected | Days | Will collections be faster, slower or the same based on the decision? |

| Inventory Days | How much inventory is currently held | Days | Will the inventory holding increase, decrease or stay the same based on the decision? |

| AP Days | How quickly Suppliers are paid | Days | Will payables be faster, slower or the same based on the decision? |

| Fixed Assets | How much fixed asset investment is held | Hundreds of thousands | Will we need to buy more fixed assets because of the decision? |

Having determined the levers that will be impacted by the decision and the range of impact, these are entered into the appropriate section of the Crystal Ball and it assesses the decision using 2 questions:

Should we do this? Can we do this?

“Should We” is determined by the movement in Return as a result of the possible change.

- An improvement in return suggests we should proceed.

- A reduction in return suggests one of 2 things:

- We should not proceed, or

- If the benefit is a longer-term strategic improvement, we should recognise that there is a short-term cost to the decision. We refer to these decisions as “J Curve” decisions and they have to be managed accordingly.

“Can We” is determined by the movement in Operational Cashflow as a result of the possible change.

- An improvement in operational cash flow suggests we should proceed.

- A reduction in operational cash flow suggests one of 2 things:

- We should not proceed, or

- If we believe the decision has a strong return benefit, (see above), we need to assess whether we can fund the cash requirement to proceed. This will either come from reserves or possible additional debt or equity contributions.

The Crystal Ball ties the “Should We” “Can We” questions to the 2 RealTime CEO primary measures of:

- Return on Operations (ROO%) – this tells you whether the decision increases or decreases the value of your business, and by how much.

- Operational Cash Flow (OCF) – this tells you how the decision impacts your cash flow, determining whether you can afford to make the decision without jeopardizing your future.

The Crystal Ball also calculates the impact on the 4 secondary RealTime CEO measures:

- Profitability – the percentage of revenue that is profit

- Leverage – how many dollars of revenue are generated for each dollar of operational investment

- Salary Multiple – how many dollars of revenue are produced for each dollar of salary and wages

- Raw Material Multiple – how many dollars of revenue are produced for each dollar of Raw Materials

Changes to the measure are “traffic lighted”:

- Green – If there is a 5% (or more) improvement

- Red – If there is a 5% (or more) decline

- Orange – Between the above parameters

Decisions can be modeled on either Historical (actual) data or Forecast data.

The changes entered do not change the underlying data, so you can input as many different scenarios as desired – just click Reset to start again.

Against each of the Direct and Indirect cost levers is a Variability percentage. The variability relates to volume changes in the business and how much Direct and Indirect costs rise and fall in conjunction with sales (volume).

If volume is impacted by the decision, consider the variability. For example, if Volume increases by 10% and the Direct Costs Other variability is set to 90%, then Direct Costs Other are modelled to increase at 90% of 10% (or 9%). The variability impacts the increase or reduction of costs when volume changes.

Current capacity will have an integral impact on this question. If there is capacity to increase volume without additional costs, then variability should be 0. If there is no capacity to increase volume without additional costs, then variability should be >0.

In RTC they default to 90% for Direct Costs and 25% for Indirect Costs. These can be changed to match your business.

Note that for the Direct Costs Other and Indirect Costs Other levers, the increase will exclude depreciation because a volume increase will not increase depreciation.

Crystal Ball Example: Should we increase our Prices?

Note: this example is modeling an increase but the Crystal Ball can also be used to model a decrease.

Assumptions made in this example:

- In scenario 1, the price is increased with no other changes (same sales volume).

- In scenario 2, we are testing a loss of sales as a result of increasing the price and are assuming a retail or manufacturing business where Direct Costs are 100% variable (based on volume). If volume decreases by 5% so will Direct Cost Wages and Direct Costs Other (assuming this is mostly materials).

- In scenario 3, we are testing what the salespeople think would be the maximum loss of sales due to a price increase. We are also assuming a retail or manufacturing business where Direct Costs Wages and Direct Costs Other are 100% variable in line with volume.

- In scenario 4, we are assuming a service business where Direct Costs Wages would change in line with volume (variability 100%), but Direct Costs Other would not change (no materials), so 0% variability.

Which levers will be affected?

| Lever | Impact – Scenario 1 | Impact – Scenario 2 | Impact – Scenario 3 | Impact – Scenario 4 |

| Price | 4% | 4% | 4% | 4% |

| Volume | – | -5% | -15% | -5% |

| DC – Wages | – | Variability 100% | Variability 100% | Variability 100% |

| DC – Other | – | Variability 100% | Variability 100% | Variability 0% |

| IDC – Wages | – | Variability 0% | Variability 0% | Variability 0% |

| IDC – Other | – | Variability 0% | Variability 0% | Variability 0% |

| AR Days | – | – | – | – |

| Inventory Days | – | – | – | – |

| AP Days | – | – | – | – |

| Fixed Assets | – | – | – | – |

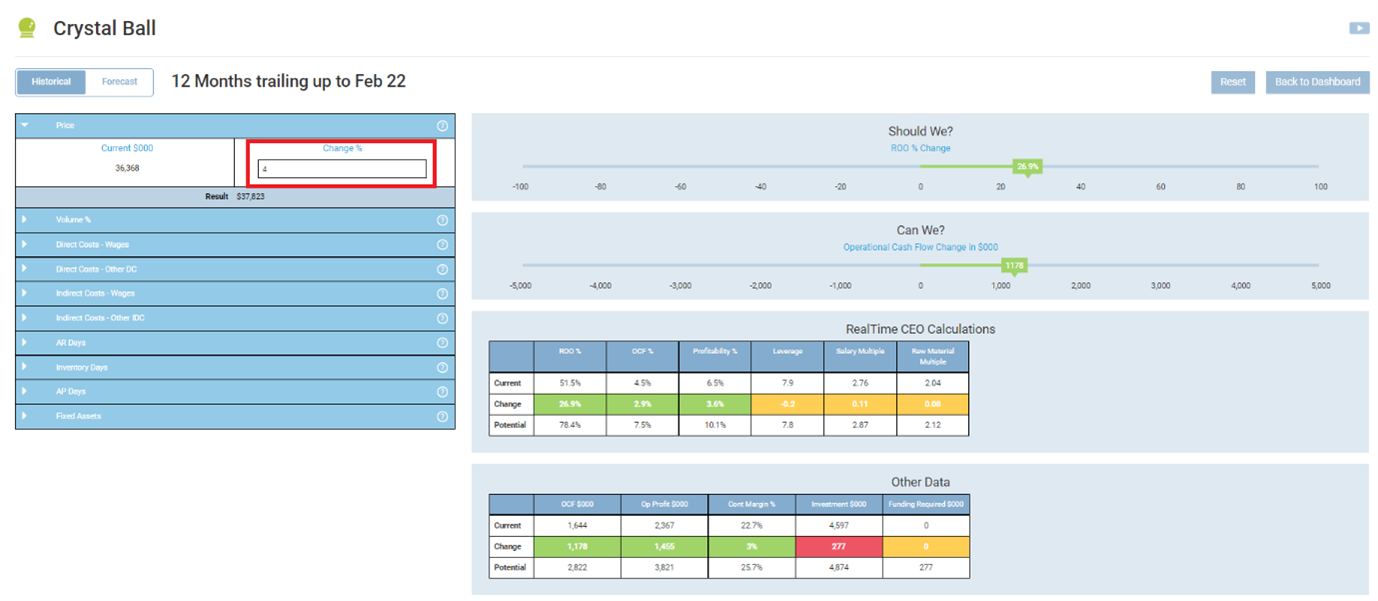

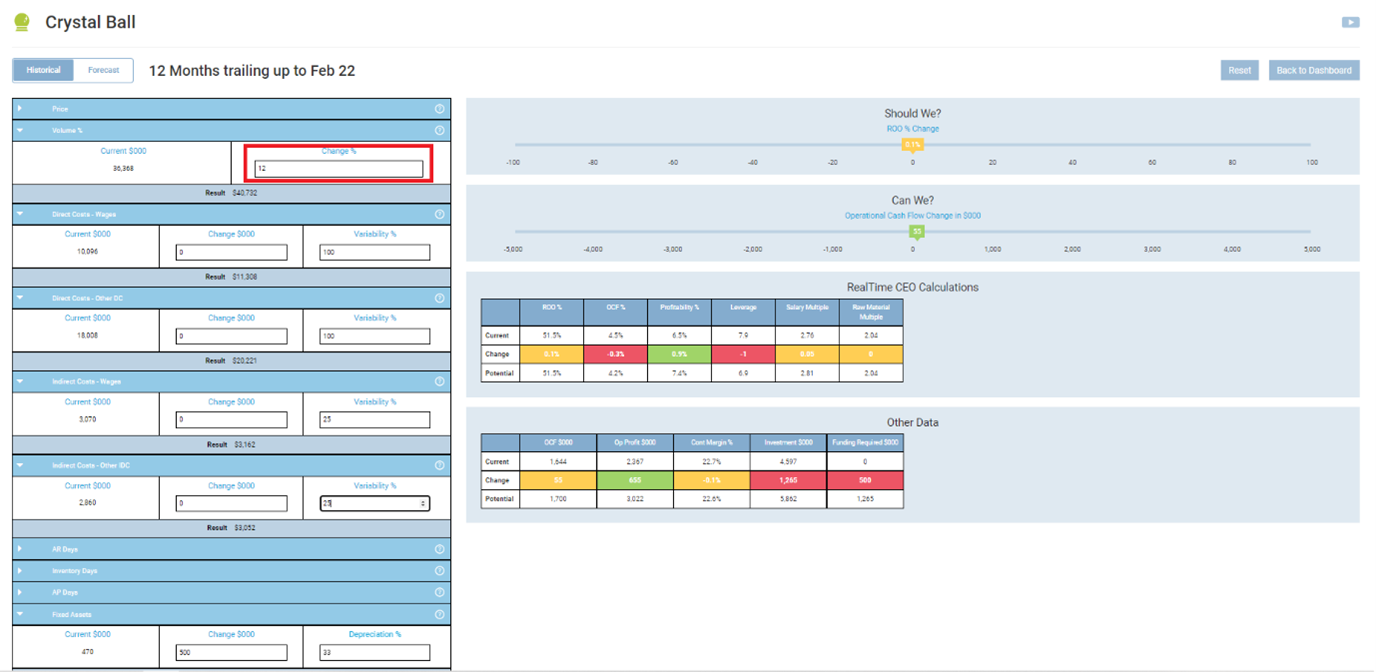

Scenario 1: A price increase of 4% with no reduction in sales (volume)

Enter 4 in the Change % on the Price lever.

This is a Yes/Yes decision. It increases Return on Operations and Operational Cash Flow.

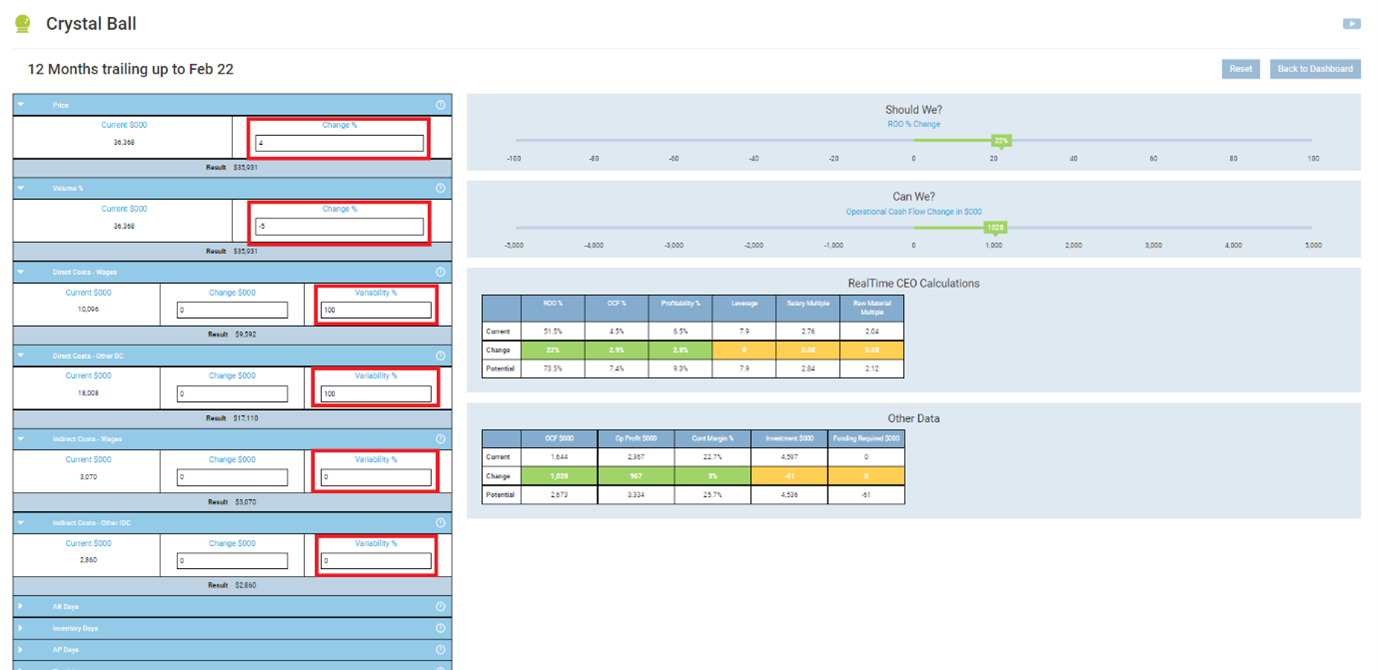

Scenario 2 – A potential loss of sales (volume) resulting from the increase in price – manufacturing or retail business

Enter -5 in the Change % on the Volume lever assuming we could lose 5% of sales, 100% in the Direct Costs Wages and Direct Costs Other variability, 0% in the Indirect Costs Wages and Indirect Costs Other variability.

It is still a Yes/Yes decision. It increases Return on Operations and Operational Cash Flow even if we lose 5% of sales.

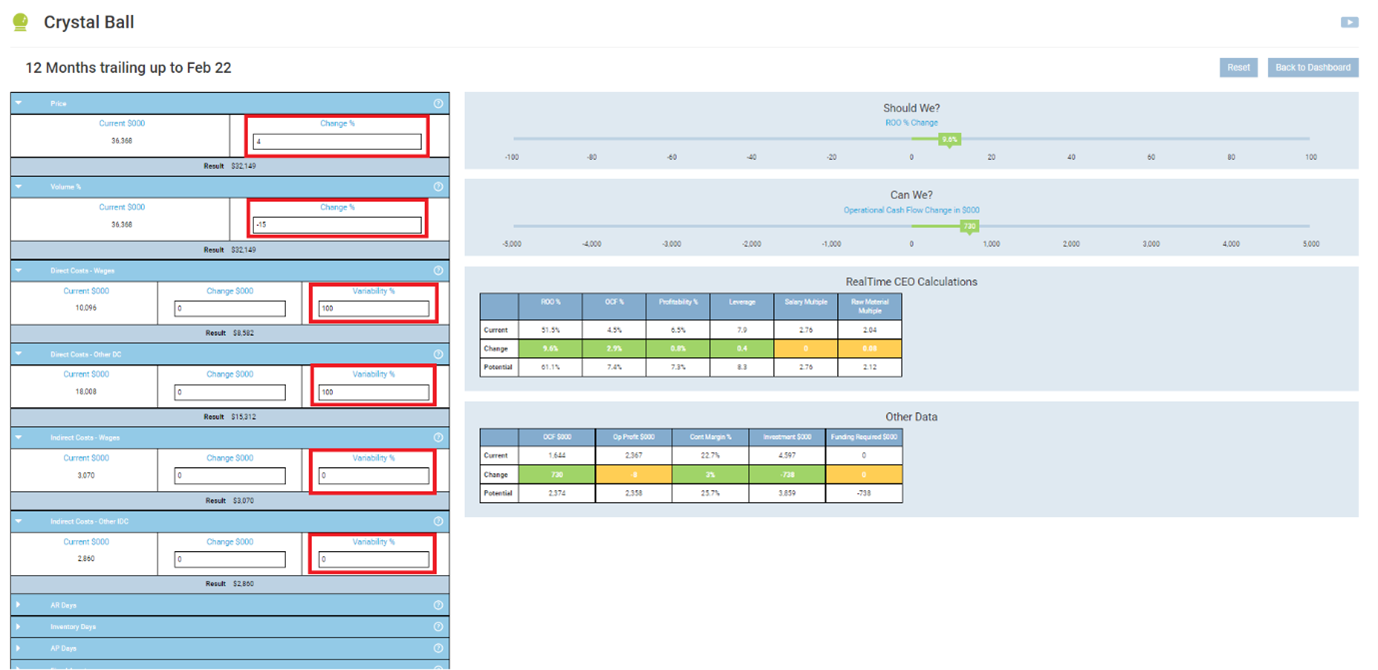

Scenario 3: What if we lost the maximum sales (worst case scenario) – manufacturing or retail business

Enter -15 in the Change % on the Volume lever assuming we could lose 15% of sales, 100% in the Direct Costs Wages and Direct Costs Other variability, 0% in the Indirect Costs Wages and Indirect Costs Other variability.

It is still a Yes/Yes decision. It increases Return on Operations and Operational Cash Flow even if we lose the maximum 15% of sales (the salespeople say this is the worst-case scenario).

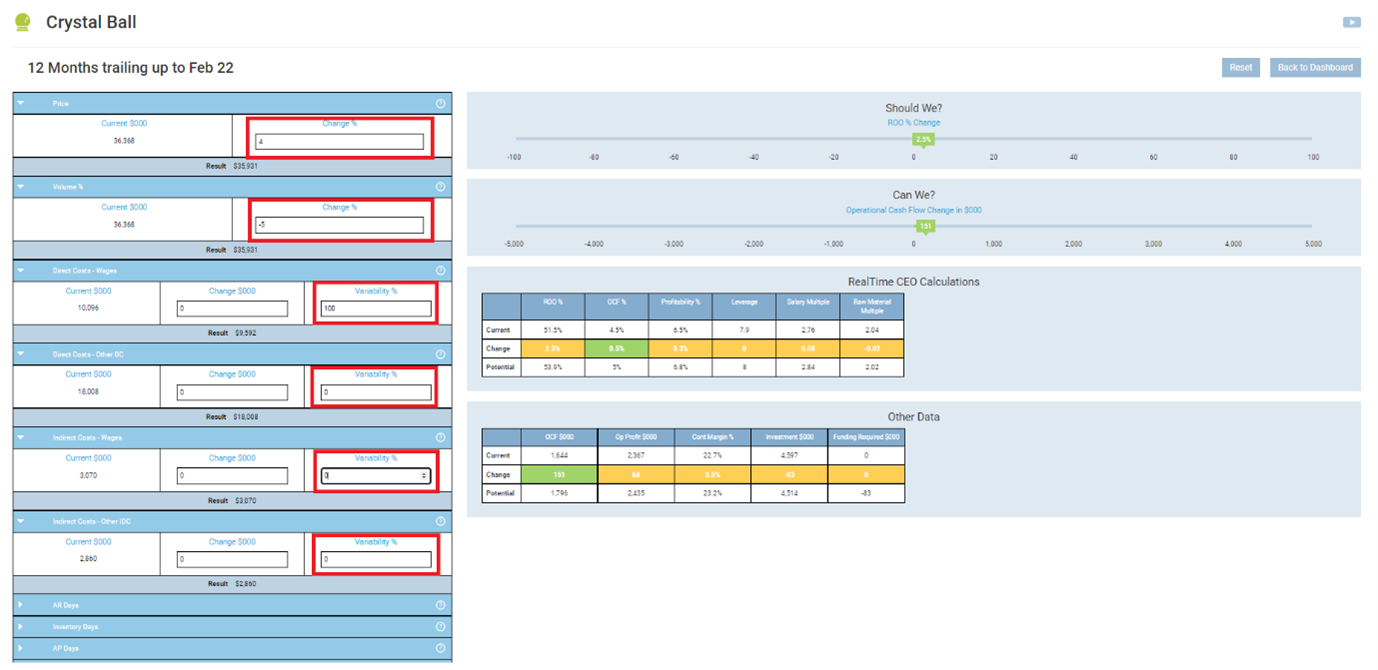

Scenario 4: A potential loss of sales (volume) resulting from the increase in price – service business

Enter -5 in the Change % on the Volume lever assuming we could lose 5% of sales, 100% in the Direct Costs Wages variability, 0% Direct Costs Other variability, 0% in the Indirect Costs Wages and Indirect Costs Other variability.

It is a Yes/Yes decision. It increases Return on Operations and Operational Cash Flow.

You can also stress test the decision. Enter different volume losses to see the point where it is no longer a Yes/Yes decision.

What if the business does not have an ‘across the board’ price increase?

To test the decision of increasing the price for one revenue source, calculate that revenue source’s percentage of the total revenue and enter a weighted percentage in the price change. E.g. the revenue source to be increased makes up 60% of the total revenue, therefore 60% of 4% increase is 2.4%, so enter that rather than 4%.

Should we hire an additional Salesperson?

In this scenario, we want to find out if it is worth hiring another salesperson at a cost of $100k. How much does the salesperson need to sell to make it worthwhile?

Assumptions made in this example:

- The salesperson’s wages are a direct cost.

- Volume increase as a result of hiring the salesperson is expected to be 10%, but we also want to stress test the decision at only 1% increase in sales.

- In scenarios 1 and 2, we are assuming a manufacturing or retail business where Direct Costs Other are materials and will increase 100% in line with volume (Direct Costs Other Variability 100%).

- In scenarios 3 and 4, we are assuming a service business where Direct Costs Other are not materials and so variability is set at 0%

- Indirect Costs Wages and Other variability is 0%.

Which levers will be affected?

| Lever | Impact – Scenario 1 | Impact – Scenario 2 | Impact – Scenario 3 | Impact – Scenario 4 |

| Price | – | – | – | – |

| Volume | 10 | 1 | 10 | 1 |

| DC – Wages | 100k +Variability 100% | 100k +Variability 100% | 100k +Variability 0% | 100k +Variability 0% |

| DC – Other | Variability 100% | Variability 100% | Variability 0% | Variability 0% |

| IDC – Wages | Variability 0% | Variability 0% | Variability 0% | Variability 0% |

| IDC – Other | Variability 0% | Variability 0% | Variability 0% | Variability 0% |

| AR Days | – | – | – | – |

| Inventory Days | – | – | – | – |

| AP Days | – | – | – | – |

| Fixed Assets | – | – | – | – |

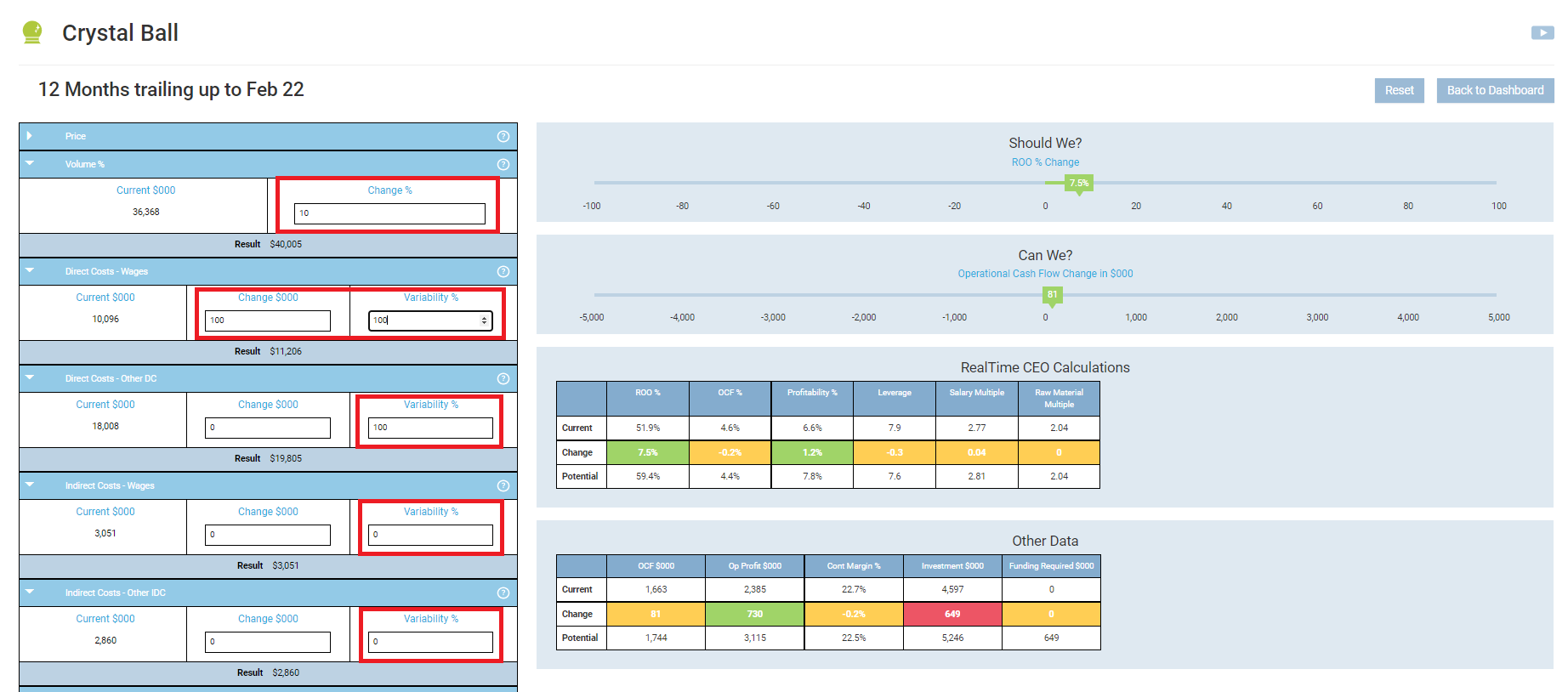

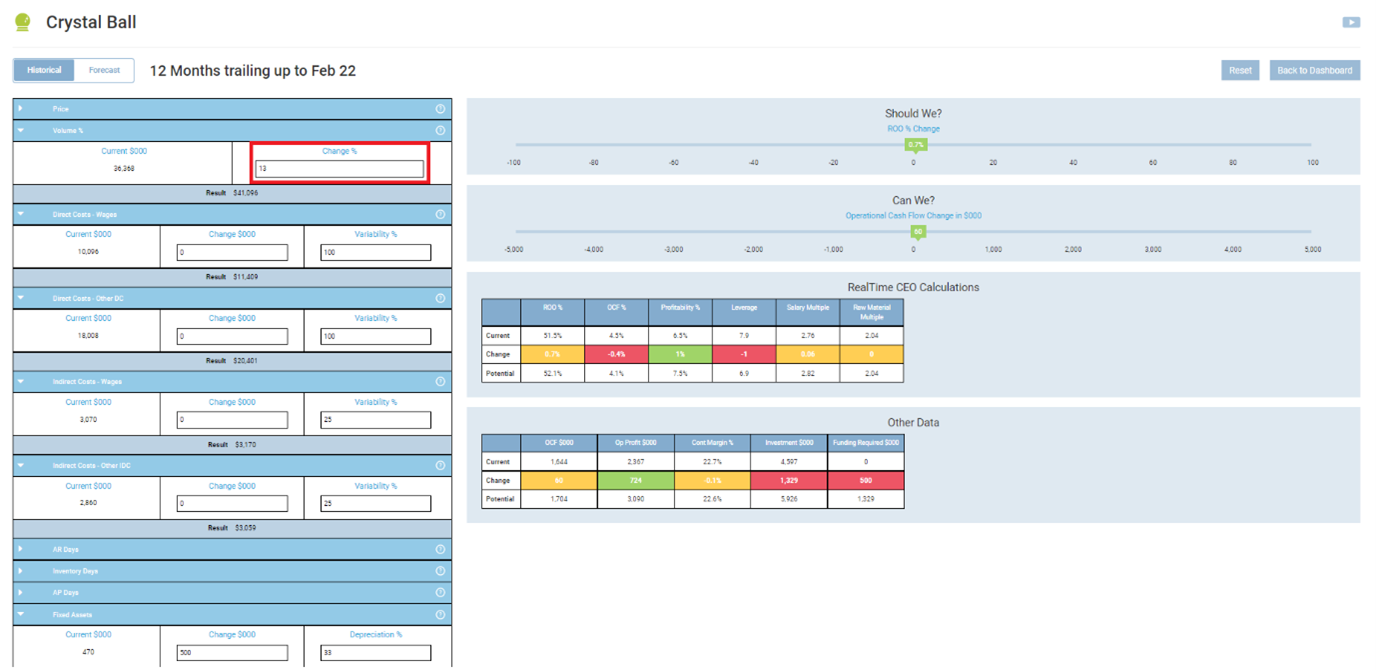

Scenario 1: Expected increase in sales volume is 10% – manufacturing or retail business

Enter 10 in the Change % on the Volume lever assuming we increase sales by 10%, 100 (k) in the Direct Costs Wages and 0% Direct Costs Wages variability, 100% Direct Costs Other variability, 0% in the Indirect Costs Wages and Indirect Costs Other variability.

In this example, it is a Yes/Yes decision. It increases Return on Operations and Operational Cash Flow.

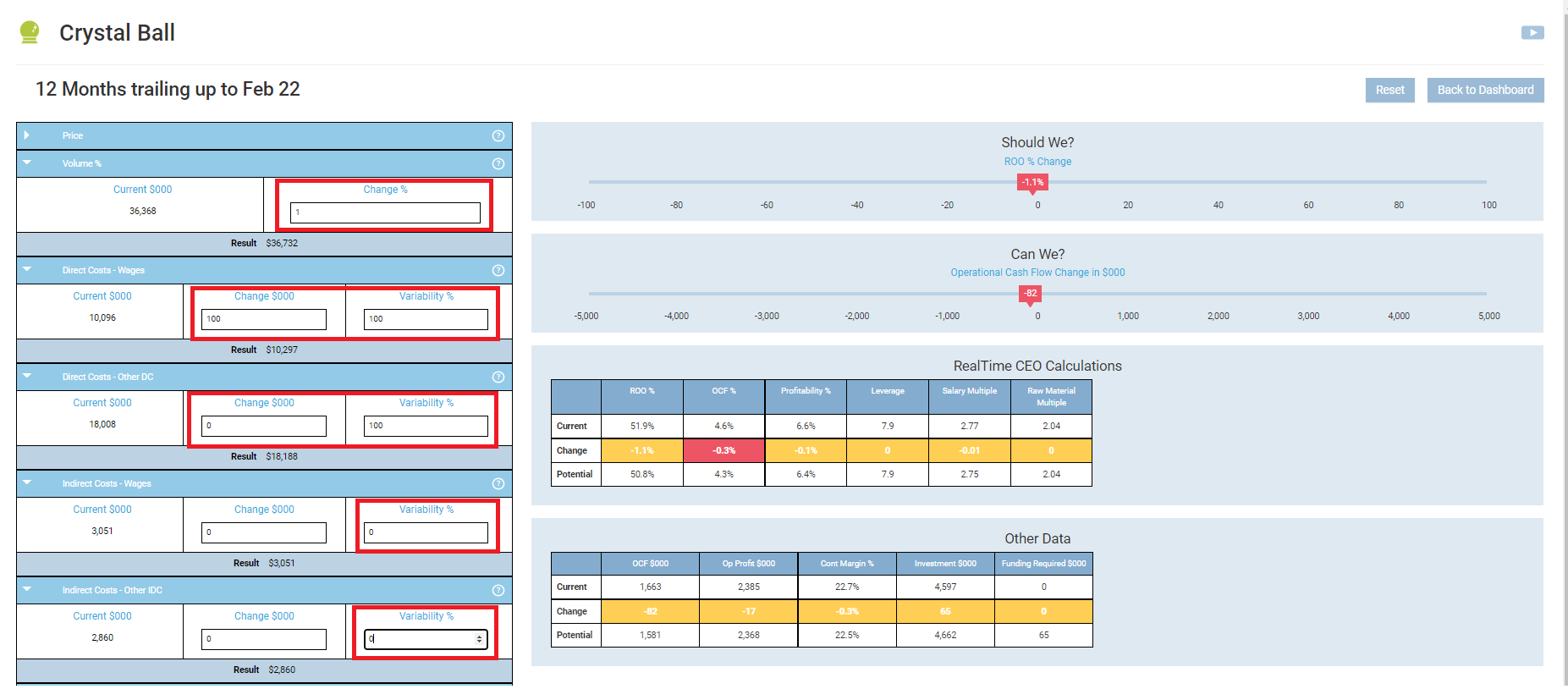

Scenario 2: Expected increase in sales volume is only 1% – manufacturing or retail business

Enter 1 in the Change % on the Volume lever assuming we increase sales by only 1%, 100 (k) in the Direct Costs Wages and 0% Direct Costs Wages variability, 100% Direct Costs Other variability, 0% in the Indirect Costs Wages and Indirect Costs Other variability.

This makes it a No/No decision.

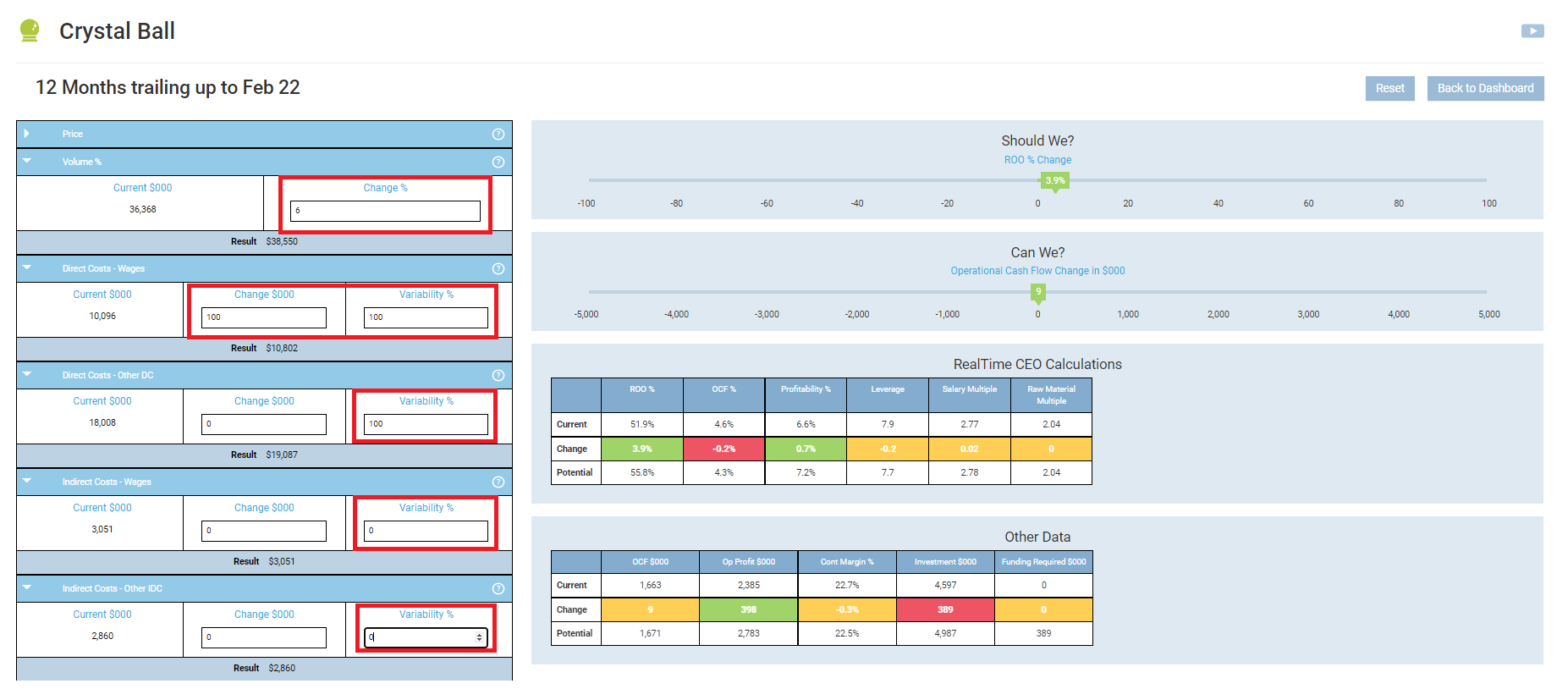

Let’s find out what the minimum volume increase needs to be to make hiring the salesperson worthwhile. Input various volume percentages until it is a Yes/Yes decision, leaving the other inputs the same as above.

The minimum volume increase needed to make hiring the salesperson worthwhile is 6%.

Scenario 3: Expected increase in sales volume is 10% – service business

Enter 10 in the Change % on the Volume lever assuming we increase sales by 10%, 100 (k) in the Direct Costs Wages and 0% Direct Costs Wages variability, 0% Direct Costs Other variability, 0% in the Indirect Costs Wages and Indirect Costs Other variability.

In this example, it is a Yes/Yes decision. It increases Return on Operations and Operational Cash Flow.

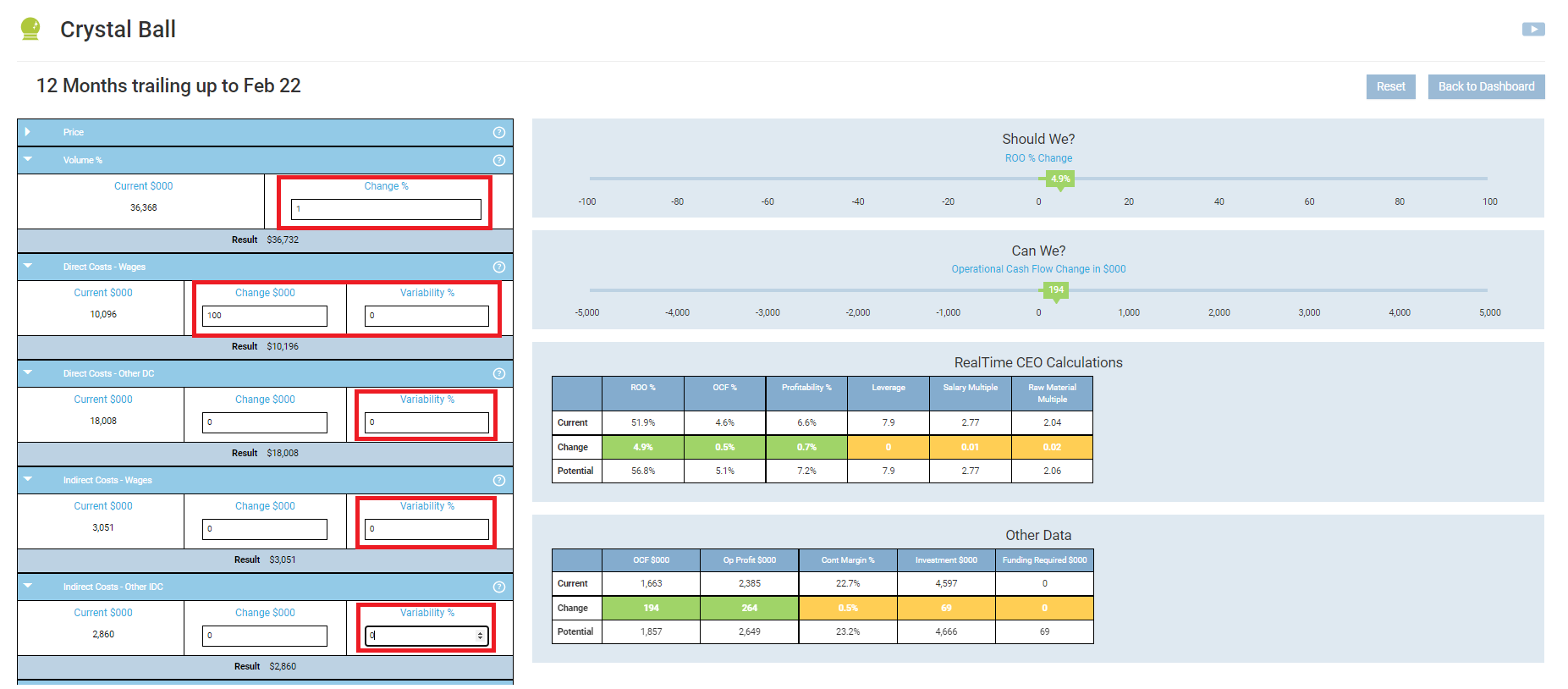

Scenario 4: Expected increase in sales volume is 1% – service business

Enter 1 in the Change % on the Volume lever assuming we increase sales by only 1%, 100 (k) in the Direct Costs Wages and 0% Direct Costs Wages variability, 0% Direct Costs Other variability, 0% in the Indirect Costs Wages and Indirect Costs Other variability.

It is still a Yes/Yes decision. Even if we only increased our sales volume by 1%, the salesperson would have a positive impact on ROO and Operational Cash Flow.

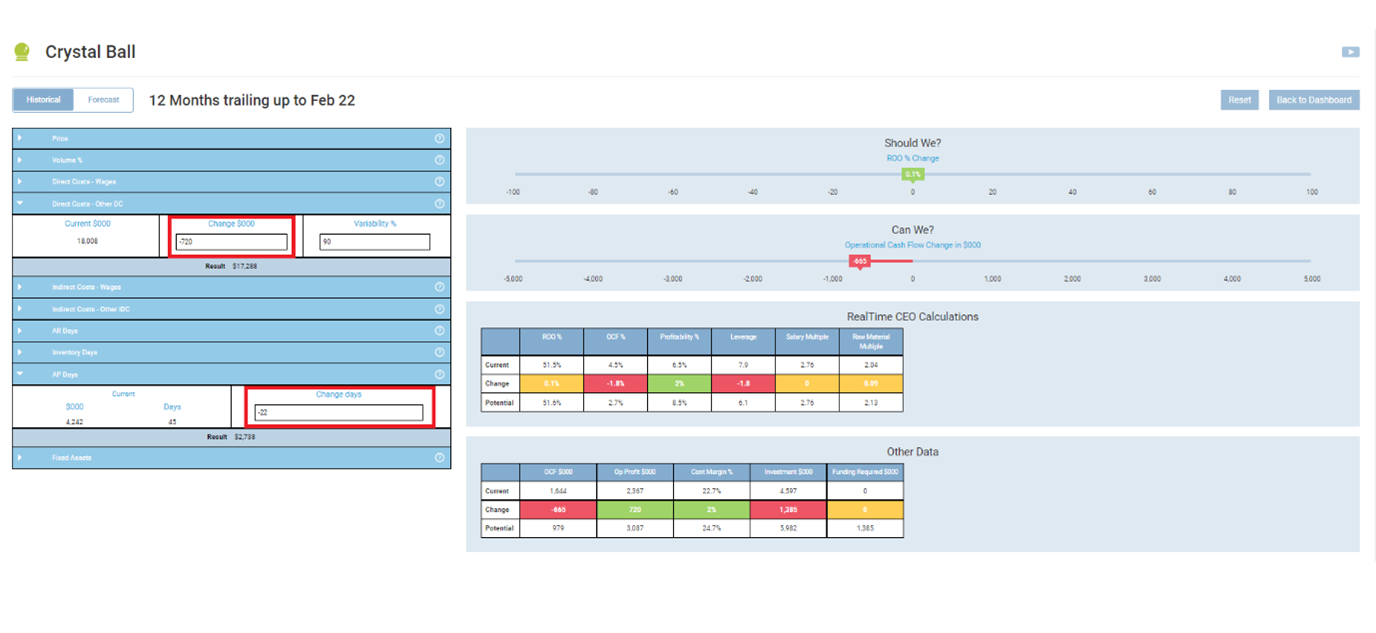

Is it worth paying our suppliers faster to receive a settlement discount?

Our major material suppliers offer a 4% settlement discount if we pay within 45 days. Our current AP days are 67. Is it worth paying sooner to take advantage of this discount?

Assumptions used in this example:

- Actual Material Costs are $18.008m in the 12 months rolling to Feb 22. $18.008m x 4% = $720k. So we will save $720k by paying this within 45 days.

- AP Days are currently 67

- Scenario 2 is working out what discount we would have to receive to make it worthwhile

Which levers will be affected?

| Lever | Impact – Scenario 1 | Impact – Scenario 2 |

| Price | – | – |

| Volume | – | – |

| DC – Wages | – | – |

| DC – Other | -720 | Enter various amounts until a Yes/Yes decision is shown |

| IDC – Wages | – | – |

| IDC – Other | – | – |

| AR Days | – | – |

| Inventory Days | – | – |

| AP Days | -22 | -22 |

| Fixed Assets | – | – |

Scenario 1: 4% discount to pay in 45 days

Enter -720 (k) in Direct Costs Other $000, and -22 in the AP Days. Note the variability is set to the default of 90% but it has no impact because we are not modeling a volume change (variability is only related to volume changes).

This is a Yes/No decision. ROO increases slightly but operational cash flow would decrease.

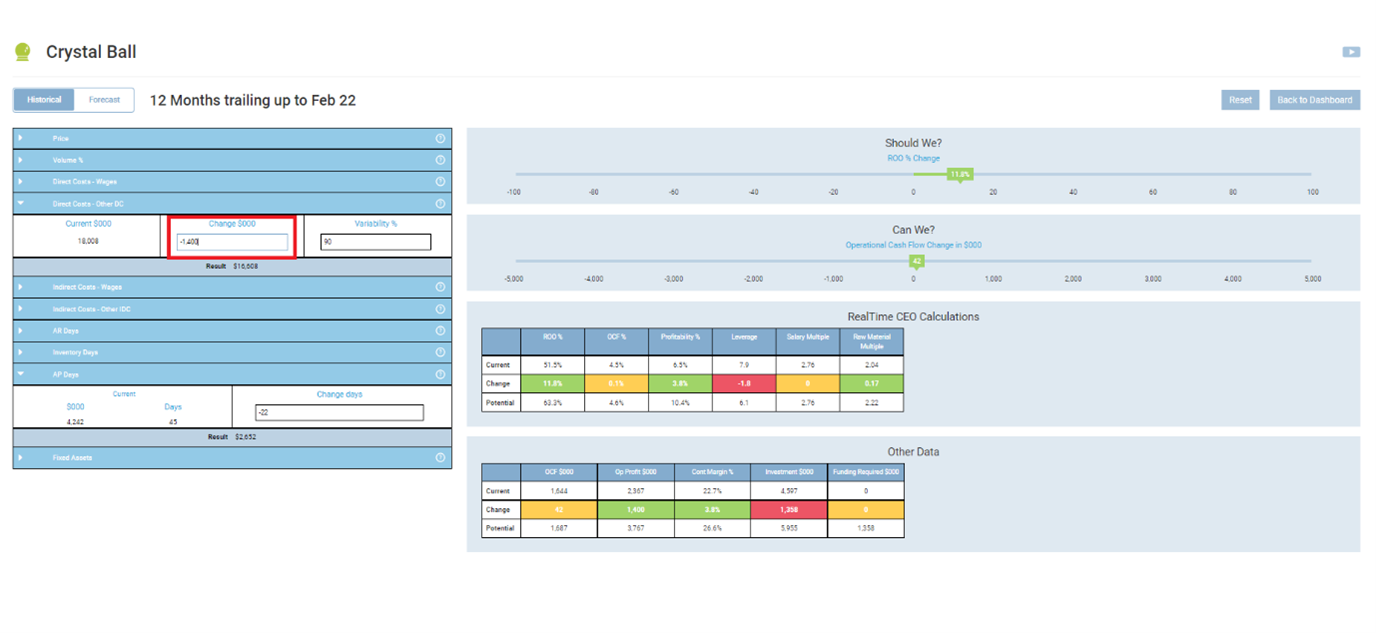

Scenario 2: What discount would we have to receive to make it worthwhile paying in 45 days instead of 67?

Enter various amounts (k) in Direct Costs Other $000, and -22 in the AP Days until you find a point where it is a Yes/Yes decision. Note the variability is set to the default of 90% but it has no impact because we are not modeling a volume change (variability is only related to volume changes).

We would have to save $1.4m which is 7.8% to make it worthwhile paying in 45 days.

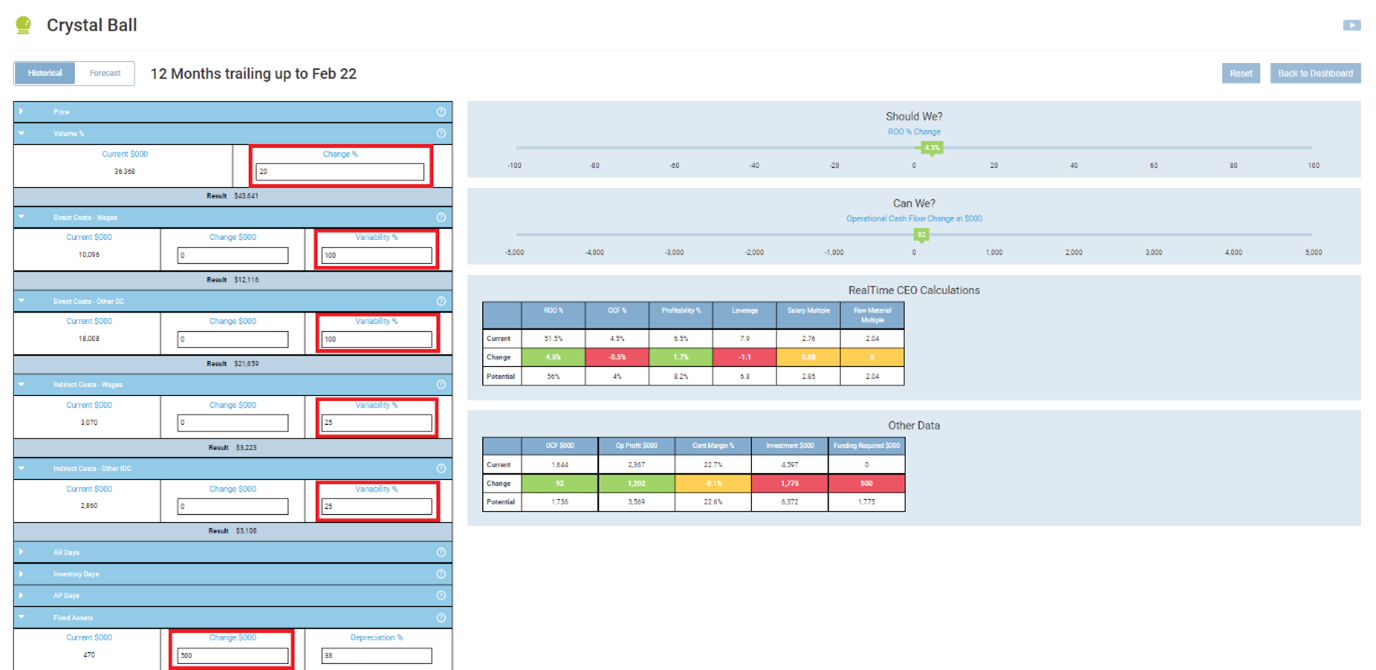

If we purchase a new machine, what additional volume do we need to sell to make it worthwhile?

We are considering purchasing a new machine at a cost of $500k, using existing funds rather than debt, and want to know how much we need to sell.

Assumptions made in this example:

- Expected Volume increase of 20%

- Direct Costs Wages – there is no spare capacity, so the variability is set to 100%, meaning if volume increases by 20%, Direct Wages will also increase 20%

- Direct Costs Other – there is no spare capacity, so the variability is set to 100%, meaning if volume increases by 20%, Direct Costs Other will also increase 20%

- Indirect Costs Wages and Other – we have left the variability at the default of 25%, meaning if volume increases by 20%, Indirect costs will increase by 25% of 20% = 5%.

- In scenario 2 we are trying to determine the least volume increase for the decision to still be worthwhile.

Which levers will be affected?

| Lever | Impact – Scenario 1 | Impact – Scenario 2 |

| Price | – | – |

| Volume | 20 | Enter various volume % changes to find the minimum volume increase for a Yes/Yes decision |

| DC – Wages | Variability 100% | Variability 100% |

| DC – Other | Variability 100% | Variability 100% |

| IDC – Wages | Variability 25% | Variability 25% |

| IDC – Other | Variability 25% | Variability 25% |

| AR Days | – | – |

| Inventory Days | – | – |

| AP Days | – | – |

| Fixed Assets | 500 | 500 |

Scenario 1: Volume increase of 20%

Enter 20 in the Volume Change %, 100% Direct Costs Wages variability, 100% Direct Costs Other variability, 25% in the Indirect Costs Wages and Other variability, 500 (k) in the Fixed Assets $000.

This is a Yes/Yes decision. Both ROO and operational cash flow would increase.

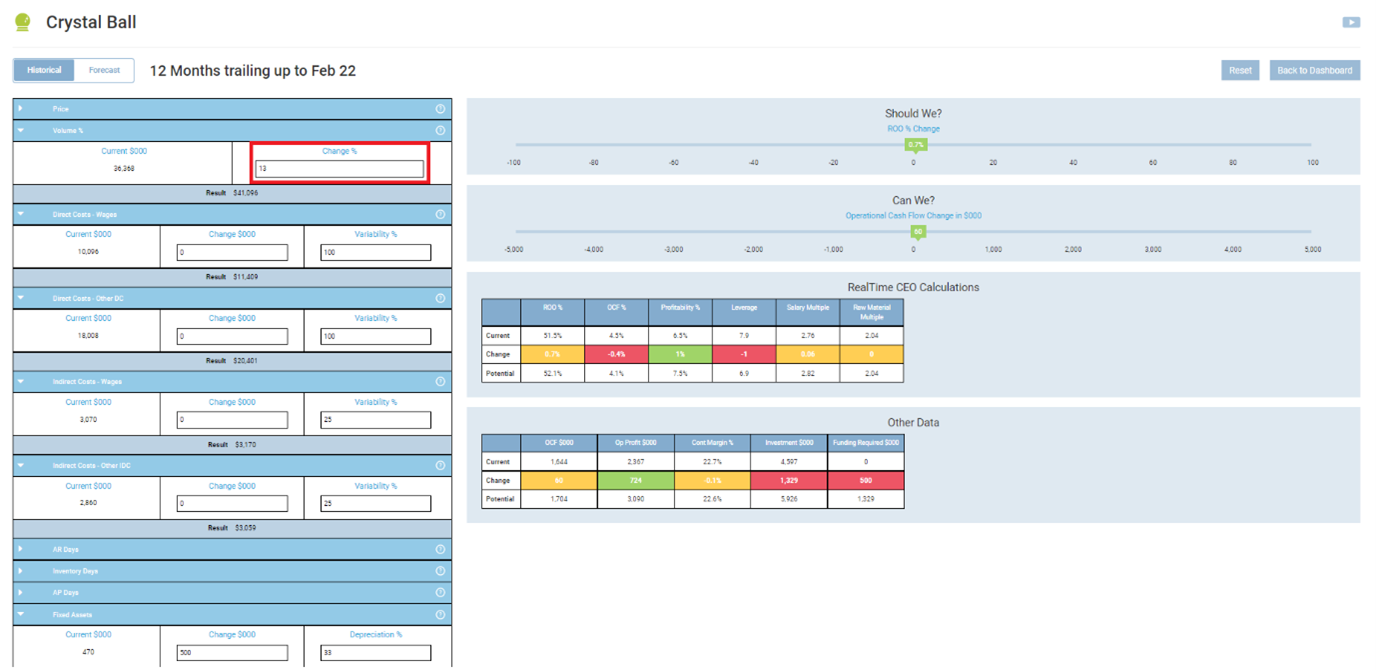

Scenario 2: What is the least volume increase for it to still be a Yes/Yes decision?

Now let’s enter a 13% volume increase, leaving all other levers the same.

It is still a Yes/Yes decision.

Try a 12% Volume increase.

At 12% it is just a Yes/Yes decision.

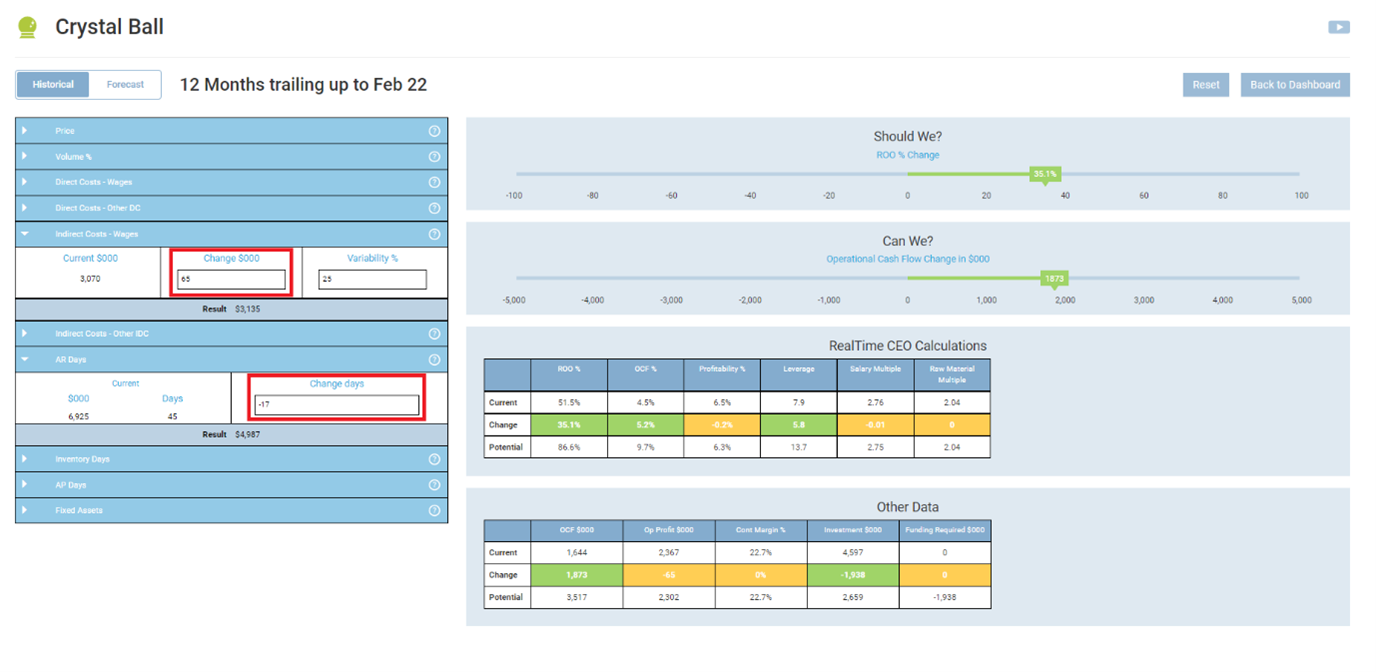

Is it worth hiring an Accounts Receivable person to reduce our AR Days?

We are considering hiring a new AR person to reduce our AR Days. They are currently 65 and we would like to get them to 45.

Assumptions made in this example:

- The cost of the person is $65kp.a.

- The wages are an indirect cost

- Current AR days are 62

- There are no other increases in costs associated with hiring the new person

Which levers will be affected?

| Lever | Impact – Scenario 1 | Impact – Scenario 2 |

| Price | – | – |

| Volume | – | – |

| DC – Wages | – | – |

| DC – Other | – | – |

| IDC – Wages | 65 | 65 |

| IDC – Other | – | – |

| AR Days | -17 | -2 |

| Inventory Days | – | – |

| AP Days | – | – |

| Fixed Assets | – | – |

Scenario 1: Hiring a new person brings the AR days down to 45

Enter 65 (k) in the Indirect Costs Wages $000, and -17 in the AR Days. Note the variability is set to the default of 25% but it has no impact because we are not modeling a volume change (variability is only related to volume changes).

This is a Yes/Yes decision.

Scenario 2: Hiring a new person brings the AR days down to 60

Now let’s see if only a minor change in a reduction in AR days results in a Yes/Yes decision.

Even if the AR days only reduce by 2, it is still a Yes/Yes decision.