- About Us

- Nick Setchell – RealTime CEO

- Vistage & TEC WorkshopsNick Setchell has been working with Vistage, the world’s largest CEO organization, since 2001.

- NewsSee what’s happening with RealTime CEO.

- Economic Update Report

- Contact UsReach out to us. If you’re interested in booking Nick to give a keynote address or workshop at your conference, please include the date and location.

- Concepts

- Fiscal Focus Financial Statement AnalysisUnlock the hidden numbers in your P&L and balance sheet to see how you’re performing in 11 vital metrics.

- Should We? / Can We?View, in real time, the actual financial impact of the hundreds of business decisions your team makes every month.

- 24 Month Rolling ForecastingBlend your trailing twelve months with a rolling 12-month forecast to get a complete financial picture of your business.

- J Curve ManagementTrack the number of investments you’re undertaking, the 3 phases of each, and the 5 rules for managing them.

- Return on Operations – ROOView your return on operations percentage — your ROO % — the most powerful number to measure business success.

- CEO Performance AnalysisBenchmark your performance as a private-company CEO against others in your industry.

- Resource Center

- Blog

- Login

- SUBSCRIBE

- About Us

- Nick Setchell – RealTime CEO

- Vistage & TEC WorkshopsNick Setchell has been working with Vistage, the world’s largest CEO organization, since 2001.

- NewsSee what’s happening with RealTime CEO.

- Economic Update Report

- Contact UsReach out to us. If you’re interested in booking Nick to give a keynote address or workshop at your conference, please include the date and location.

- Concepts

- Fiscal Focus Financial Statement AnalysisUnlock the hidden numbers in your P&L and balance sheet to see how you’re performing in 11 vital metrics.

- Should We? / Can We?View, in real time, the actual financial impact of the hundreds of business decisions your team makes every month.

- 24 Month Rolling ForecastingBlend your trailing twelve months with a rolling 12-month forecast to get a complete financial picture of your business.

- J Curve ManagementTrack the number of investments you’re undertaking, the 3 phases of each, and the 5 rules for managing them.

- Return on Operations – ROOView your return on operations percentage — your ROO % — the most powerful number to measure business success.

- CEO Performance AnalysisBenchmark your performance as a private-company CEO against others in your industry.

- Resource Center

- Blog

- Login

- SUBSCRIBE

Crystal Ball Example: If we purchase a new machine, what additional volume do we need to sell to make it worthwhile?

If we purchase a new machine, what additional volume do we need to sell to make it worthwhile?

We are considering purchasing a new machine at a cost of $500k, using existing funds rather than debt, and want to know how much we need to sell.

Assumptions made in this example:

- Expected Volume increase of 20%

- Direct Costs Wages – there is no spare capacity, so the variability is set to 100%, meaning if volume increases by 20%, Direct Wages will also increase 20%

- Direct Costs Other – there is no spare capacity, so the variability is set to 100%, meaning if volume increases by 20%, Direct Costs Other will also increase 20%

- Indirect Costs Wages and Other – we have left the variability at the default of 25%, meaning if volume increases by 20%, Indirect costs will increase by 25% of 20% = 5%.

- In scenario 2 we are trying to determine the least volume increase for the decision to still be worthwhile.

Which levers will be affected?

| Lever | Impact – Scenario 1 | Impact – Scenario 2 |

| Price | – | – |

| Volume | 20 | Enter various volume % changes to find the minimum volume increase for a Yes/Yes decision |

| DC – Wages | Variability 100% | Variability 100% |

| DC – Other | Variability 100% | Variability 100% |

| IDC – Wages | Variability 25% | Variability 25% |

| IDC – Other | Variability 25% | Variability 25% |

| AR Days | – | – |

| Inventory Days | – | – |

| AP Days | – | – |

| Fixed Assets | 500 | 500 |

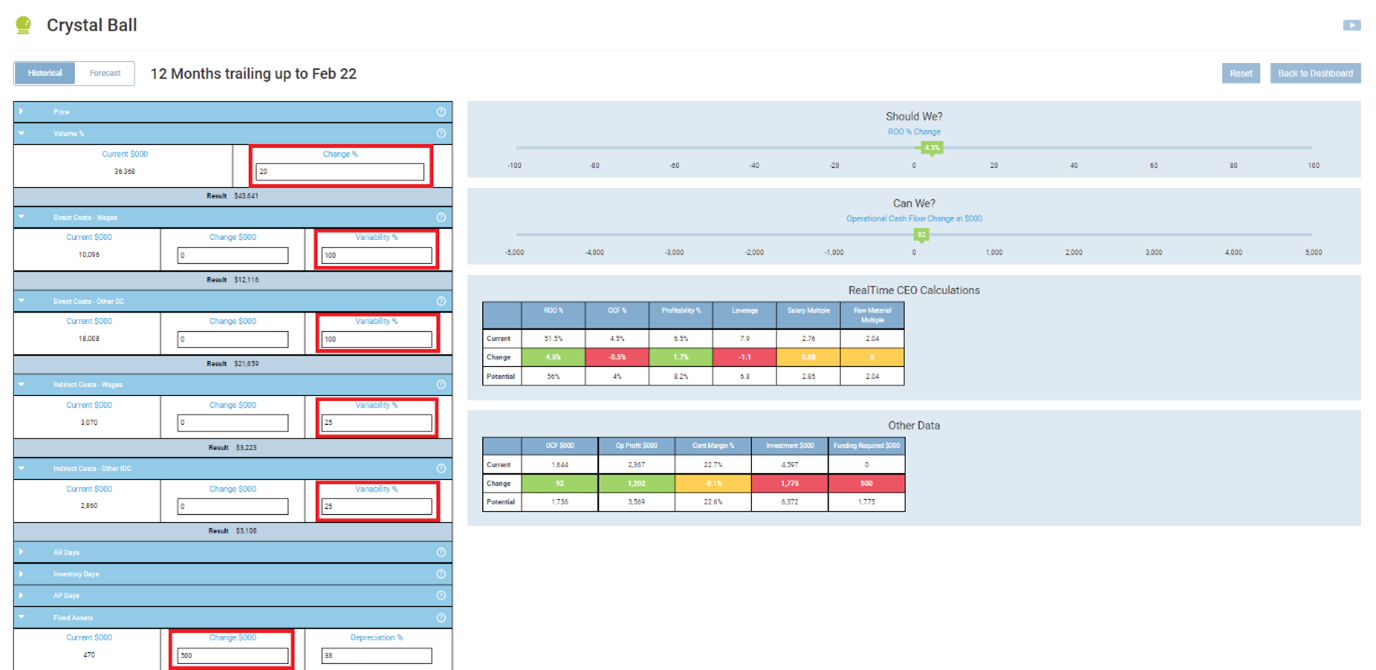

Scenario 1: Volume increase of 20%

Enter 20 in the Volume Change %, 100% Direct Costs Wages variability, 100% Direct Costs Other variability, 25% in the Indirect Costs Wages and Other variability, 500 (k) in the Fixed Assets $000.

This is a Yes/Yes decision. Both ROO and operational cash flow would increase.

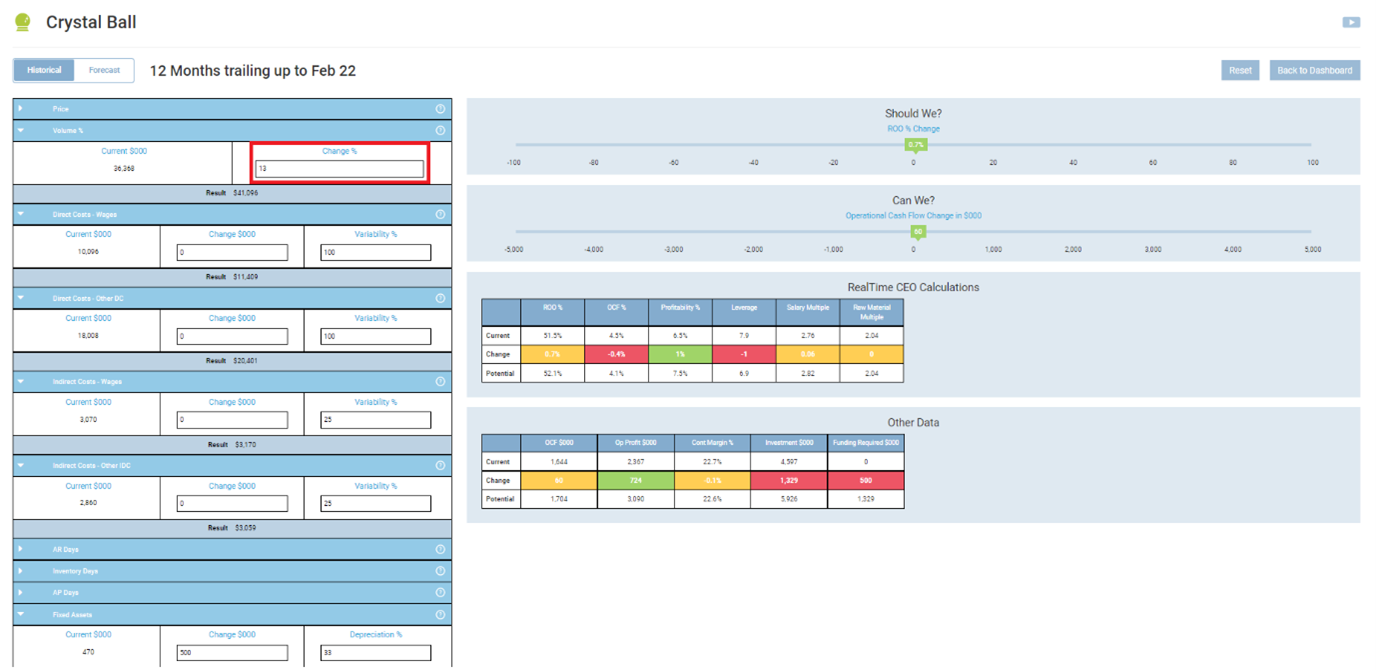

Scenario 2: What is the least volume increase for it to still be a Yes/Yes decision?

Now let’s enter a 13% volume increase, leaving all other levers the same.

It is still a Yes/Yes decision.

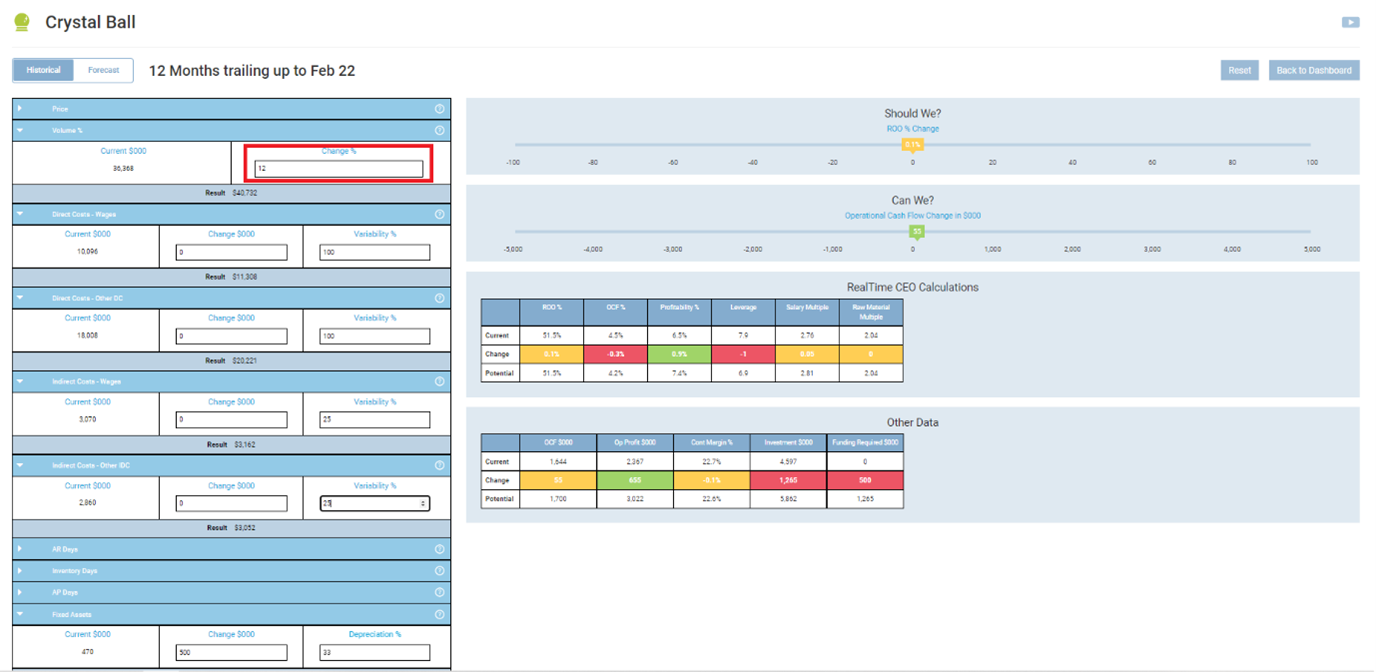

Try a 12% Volume increase.

At 12% it is just a Yes/Yes decision.

Company

Contact Us

© 2024. RealTime CEO. All Rights Reserved