Something New is Coming…

In our last post, we discussed the mechanics of 24 month rolling forecasts. (Ok, we realize that was over a year ago.)

Wait…

Did you think we’d just let that one slide?

The past 12 months have been incredibly busy for us. In addition to our continually expanding client base and Nick’s RealTime CEO workshops throughout the year in the US, Australia and the UK, we’ve been undertaking quite a large project since the end of 2014

What is it? While we’ve been keeping it under wraps during development, we decided to give you a hint since we expect to reveal it soon. In the near future, we’ll be working with select Vistage Chairs, CEO group leaders and CEOs/CFOs to complete the final testing of our new financial modeling software.

Instead of being local software similar to our current and previous versions, our new app will be delivered via software-as-a-service (SaaS). It’s designed for large groups of users to apply the RealTime CEO principles to their existing financial statements, including 24 Month Rolling Forecasting and our Crystal Ball, on their own, in real time.

This won’t fully replace our existing software which we customize for our current client base; it will provide the core features and functionality in the SaaS format to allow more companies to apply the powerful concepts and financial tools to their business. We expect it to be a key driver of our future growth and to allow us to make an impact with businesses anywhere in the world (instead of just with existing client relationships with companies in the US, Canada, Australia and the U.K.).

It’s been quite an undertaking. We’re excited that the journey is nearing completion and we expect to be actively blogging again soon and engaging with our users online.

We’re currently staging the final testing along with a carefully-controlled CEO group rollout, but if you’d like to be involved before we reach out to you, connect with us to request early access.

Cheers,

Nick and the RealTime CEO team

Mechanics of RealTime 24 Month Rolling Forecasts

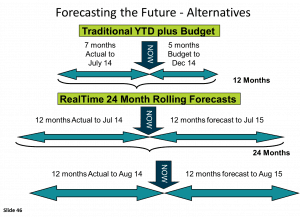

In our last blog, Forecasting the Future – Alternatives, we discussed the benefits of RealTime 24 Month Rolling forecasts. In this blog, we’ll give you more information about how RealTime 24 Month Rolling works.

The 24 Month view includes the actual figures for the past twelve months and the forecast figures for the next twelve months. For example if the current month is August 2013, we have twelve months of actual figures back to September 2012 and twelve months of projected figures to July 2014. As each month ends, you replace the projected figures for that month with actual ones. At the end of August, replace the August projected figures with the actual ones, drop off September 2013 and add August 2015 with the forecast figures for that month. This way, you’re always looking twelve months ahead.

Here’s an example –

Mechanics of 24 Month Rolling

Our forecasts provide the basis for a monthly conversation about the strategic, then the operational, then finally the numerical business landscape. It’s so easy to focus on the numbers but it’s really important to cover the strategic and operational issues before the numbers. Consider the journey before jumping straight to the solution. You can guide the conversation by asking three questions:

1. What information has come to light in the last 30 days that changes our view of the future?

Some of the issues to consider for this question are:

- What is our proposed market strategy going forward?

- Are we opening up new markets?

- Are there new competitors in the market?

- Are we launching new products or services?

- Is our product/service mix changing?

- Have projects slipped back or come forward?

- What is happening in our supply chain – availability/ reliability/ price?

2. How will we change our behaviour?

3. What will be the numerical implementation of these changes?

As we illustrated in our Sensitivity Analysis, you can use the eight Fiscal Focus levers to determine the impact that small changes in the levers will have on the overall health of your business. The sensitivity analysis tells us which levers have the most dramatic impact and which have the least impact. So it makes sense to have a forecast that puts the most important levers first, to drive the conversation towards the more relevant topics.

When we forecast, what sort of model should we use? There’s the aspiration model, which is what you want to achieve or there’s the reality model, which is what you know you can achieve with the resources you have. The difference depends on which category your revenue belongs to. You can use the marriage/engagement/dating analogy to assess your revenue certainty levels. Marriage revenue – you have a contract or you are absolutely certain of getting the revenue. “Engagement” revenue – also known as pipeline; you can list the amounts but you’re not certain. “Dating” revenue – you can’t list the details and you have no certainty of getting it. The “engagement” and “dating” revenue becomes your sales risk profile.

For more information about how RealTime 24 Month Rolling can benefit your business, contact us. We’d love to help your business.

Forecasting the Future – Alternatives

Forecasting the future relies on an accurate method of measuring past and current performance. As the year progresses, everything is compared back to the figures provided at the beginning of the year. Many businesses operate this way mainly because that’s the way they’ve always done it. This limits your view to the number of months that have passed since the start of the year and may cause trends to be missed. The YTD method does have value when you need to estimate tax but leave that to the accountants; RealTime CEOs need a more effective method of forecasting everything else.

What if you could always have a complete set of data for twelve months or twenty-four months, no matter what time of the year it is? In our blog 24 Month Rolling Forecasts, we discussed the Trailing Twelve Month method of measuring your business’s performance. This method gives a twelve-month view of your business at any given time. As one month drops off, another month adds on. But what if we could look even further ahead?

Imagine you’re driving along the freeway in a shiny, new sports car… Research tells us that we maintain a field of vision of about 120 metres in front of us. What happens in that field of vision helps you make decisions while driving your car. Now, we don’t just keep looking ahead to the same spot, otherwise we’d end up looking at the front of our car, which would be really dangerous. Instead we keep looking ahead in that field of vision. This is what we want to do when we measure business performance. When you look ahead to the end of the year, the distance is shrinking as you get closer to it. What we want to do is maintain your field of vision ahead of your business.

We can better accomplish this with RealTime 24-Month Rolling Forecasts. In our next blog, we’ll examine the mechanics of RealTime 24-Month Rolling forecast. You can also contact us for a plan that’s tailored to your business.

24 Month Rolling – Resistance to 24 Month Rolling

In my last blog on 24 Month Rolling I introduced you to the concepts of Trailing 12 Month Measurement (TTM) and 24 Month Rolling Forecasts. Today we will be looking at areas of resistance to 24 Month Rolling.

I’ve implemented my 24 Month Rolling system on numerous occasions to businesses all around the world. Each time I’ve met with resistance from someone in the company.

24 Month Rolling forecasting is a different approach to predicting and influencing the future. Our 24 Month Rolling software provides you with trailing twelve months (TTM) figures plus projections for the next twelve months, in the one statement. This gives you the best possible picture of your business performance, incorporating past, present and future. It’s not just a forecast mechanism; if adopted properly, this process can have a profound impact on your management culture and effectiveness. But because it’s so different, people are going to resist it because they don’t like change.

Some of the more common areas of resistance are:

1. We don’t have a crystal ball to determine the future. What if our forecast is wrong?

I can deal with this quickly and take the pressure off them by saying that all forecasts are going to be wrong. Nobody has a crystal ball; nobody has a perfect view of the future. This process has never been about the forecast being right or wrong. It’s about the forecast being as accurate as it can be, given all of the information you have at your disposal. And then assessing what our risk profile is if reality is different from the forecast.

2. The idea that we’re moving the goalposts. If each month, we go in and change the numbers on our forecast, how will we ever know where we are?

There’s significant difference between forecasting your perception of the road ahead for the business and changing the targets that you want to achieve. 24 Month Rolling doesn’t change the targets, it simply tracks, as more information comes to light, whether or not you are above or below a target on a 12 month rolling basis.

3. Budgets take time to prepare and then they need to be signed off by the Board. The preparation and approval process takes more than a month so to try to do this each month would be impossible.

Let me address that very clearly. 24 Month Rolling does not replace the necessity, if the necessity exists, to report to external parties on an annual basis, whether that party is a board, a bank or any other external party. 24 Month Rolling is the internal management mechanism, which not only predicts but also influences the future ahead of the business. The real value here is that everything you’re doing in your once a year set period can be done using a rolling 12-month period. Once a year a rolling 12-month period will be identical to a fixed annual period. So everything you’re doing in your fixed annual period, you can do with 24 Month Rolling. The only difference is that 24 Month Rolling will be useful twelve times a year. The fixed annual period will only be useful once a year. But there’s no reason why you can’t take a copy of the forecast from 24 Month Rolling, lock it down for twelve months and send it to the Board for signoff. That can happen as an adjunct to the 24 Month Rolling process.

4. Some transactions are only processed once a year e.g. depreciation.

As long as those transactions are processed in the same month each year then every 24 Month Rolling period will have one of those months. For example, if depreciation is processed in June (as it typically is in Australia) or December (as it typically is in the US) each year, then every rolling 12-month period has one June or one December. So you will always have those once a year transactions included.

5. This takes too much time and will cause more work than we’re currently doing.

The reality is that once the process is set up, 24 Month Rolling will be less work, not more. In fact, it will share the workload of predicting and influencing the future across all executives, not just the finance team.

6. People don’t like the word budgeting.

Quite right. Everywhere I go, people hate the word budgeting so we don’t use that word, we talk about forecasting or planning.

7. My accounting system will not handle this process.

Any limitations the accounting system may create are irrelevant because it’s not within the accounting system that we’re going to manage this process. In our next blog we’ll be talking about the some of the common pitfalls of 24 Month Rolling however, one of the more common pitfalls is to set up your forecast the same as your accounting system chart of accounts. If you do this your forecasting process will not be as effective as it should be.

8. I already have a crowded management agenda, how am I going to fit an extra item into it?

We state and now have strong evidence from my experiences around the world, that the conversations coming out of 24 Month Rolling are some of the most valuable monthly conversations that executive teams can have. Our response is that one of the agenda items currently in your meeting is probably wasting time. Remove that item and put this one right at the top.

My final comment is not so much an area of resistance but an anecdote. At one of my presentations in the UK I was confronted by a somewhat angry Englishman who said (you’ll have to imagine the upper-class English accent), ‘This is blindingly obvious. Why haven’t my financial resources told me about this before?’ He was quite angry that he hadn’t been told something so powerful and something so obvious. I’m very glad that in the end he didn’t shoot the messenger but was able to benefit from our process when he saw how much it could do for his business.

Come back and join us next time when we’ll discuss the common pitfalls associated with implementing 24 Month Rolling. Also, feel free to contact us to find out how we could help in your business.

24 Month Rolling Forecasts

Do your company’s reporting methods guide you into the future or force you to look backwards? 24 Month Rolling Forecasts provide a powerful management technique that helps you predict and influence the future.

For over a decade I’ve had the privilege of working with businesses in the US, Australia, Canada, the UK and New Zealand, across a wide range of industries. Many of them have been very successful companies, led by shrewd CEOs.

However, when analyzing their financial statements and methods of budgeting, I am constantly surprised that so many companies continue to rely on Year-to-date measurement and annual budgeting.

While Year-To-Date (YTD) is the most common method of financial measurement, it is also the least effective. Likewise, even though annual budgeting is the most common format it is fundamentally flawed.

Today I’m going to introduce the concept of Trailing 12 Month Measurement (TTM) and 24 Month Rolling Forecasts.

Limitations of Year-to-date (YTD) measurement and traditional budgeting

YTD only measures performance over a full year once every year (at the end of the fiscal year). For the other 11 months it is measuring an incomplete year thereby exposing the user to seasonal variation.

Traditional budgeting is also flawed for many reasons:

- Only done once per year

- Focuses only on the income statement,

- Often driven by the CFO who is not necessarily the best qualified person in the business to predict and influence the future.

- Each month hours are wasted comparing variances between actual and budget. These variances may be simply that changes that have arisen during the year that weren’t visible when the budget was made. Even the best CEOs probably don’t have real psychic ability!

Consider this analogy:

Companies that budget their future for the next twelve months, without updating it each month, are like a car driver who stares at a spot 120 metres in front of them and continues to stare at the same spot until they reach it. Safe drivers know to keep their field of vision consistently forward.

Are you staring at a spot on the road and putting your business at risk? Or do you believe that business conditions are constantly changing and each month we learn new and valuable information about the road ahead?

Why is Trailing Twelve Month (TTM) and 24 Month Rolling more effective?

TTM is underpinned by the internal recognition that each month is the conclusion of a 12 month period. No month end is any more important than any other. By viewing the business this way, we remove the impact of seasonality. This is important because seasonality can create a veil that disguises trend changes.

24 Month Rolling forecasts have numerous advantages over traditional budgeting, not least is the ability to accommodate a rapidly changing landscape. If a business could confidently say their landscape only changed once a year, traditional budgeting would be fine, however, I have never met a business that could say that!

24 Month Rolling forecast provides you with trailing twelve months (TTM) figures plus projections for the next twelve months, in the one model. This gives you the best possible picture of your business performance, incorporating past, present and future.

Imagine if you could get inside a time machine to go forward in time 12 months… You could see where your company is at that point of time and look back to the “current date” with all the benefits of hindsight. And if you weren’t happy with your hindsight view of the current date, you could jump back in the time machine and return to the current data and do something about it in RealTime. 24 Month Rolling Forecasts provide that time machine!

RealTime CEOs learn from the past so they can influence the future by acting now, in RealTime.

In the next 24 Month Rolling post, I will expand on how to overcome predictable yet meaningless resistance to 24 Month Rolling forecasts.

If you would like to find out more, you can always contact us. We’d love to hear from you.

Stay Connected

Find out how much value you're creating by subscribing now.

Recent Posts

- ‘COVID-Zero’: Can We Afford It?

- Economics After COVID: Boom, Bust, or Something In-Between?

- Voodoo Finance For Sick Markets: Stock Prices During COVID-19

- Modern Monetary Theory

- Financial Forecasting – Introducing a Powerful New Module of the RealTime CEO Software

Categories

- Fiscal Focus (2)