Financial Forecasting – Introducing a Powerful New Module of the RealTime CEO Software

For many executive teams, financial forecasting is a cumbersome, time-consuming and wildly inaccurate process. It’s so frustrating that some private mid-market companies have given up on it entirely.

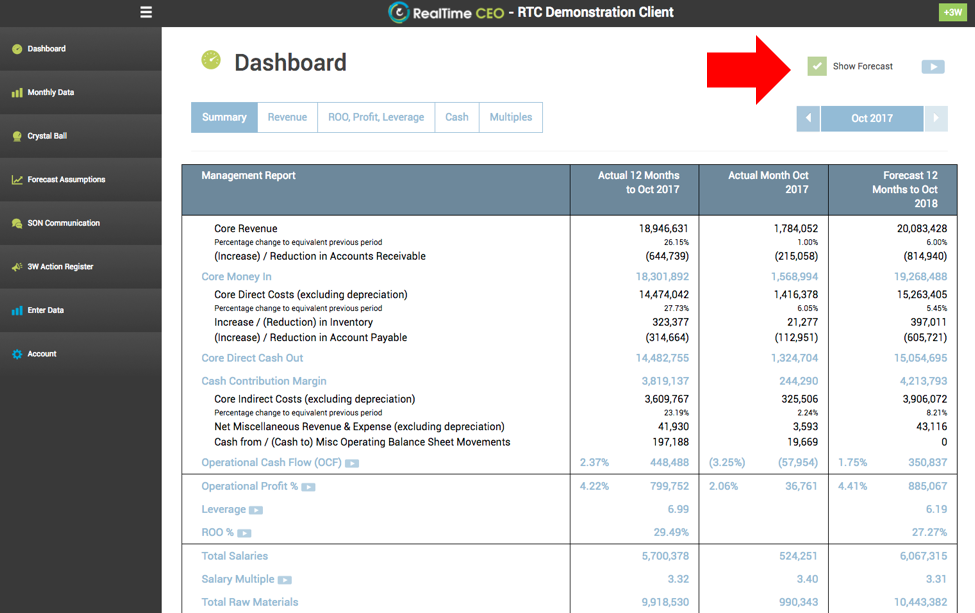

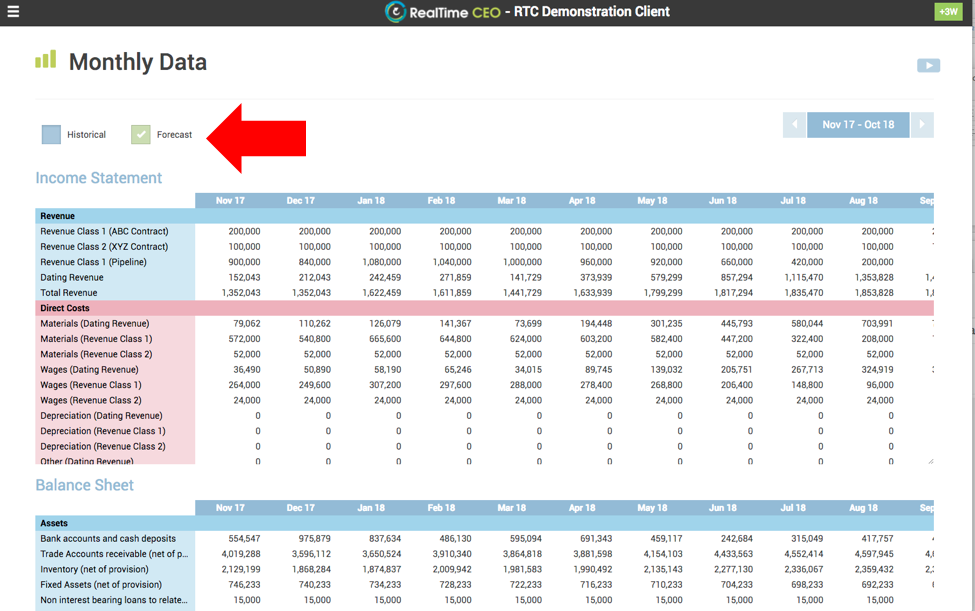

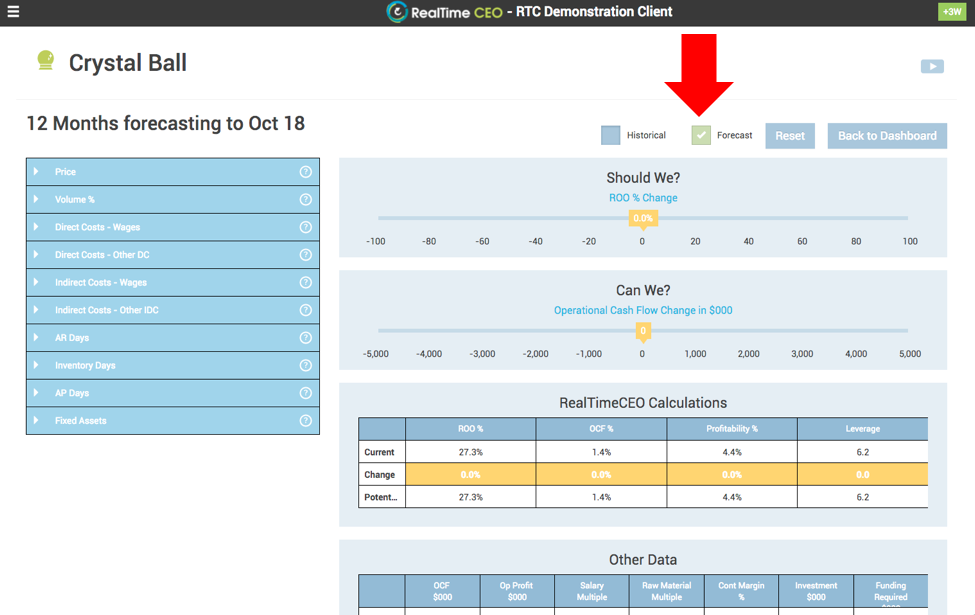

With the new forecasting module in our RealTime CEO software, creating a comprehensive forecast is as simple as clicking a button.

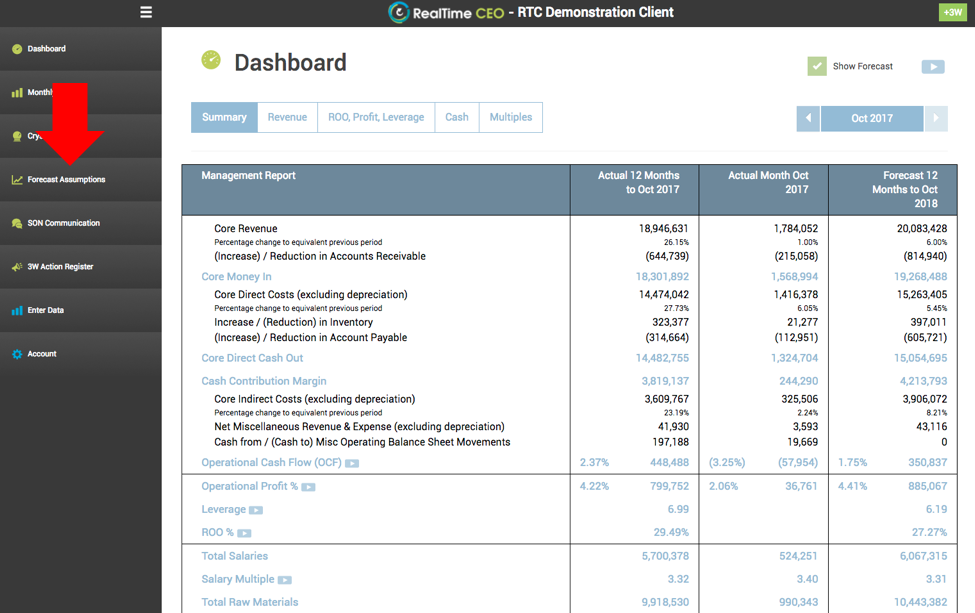

Our new forecasting module takes your current and historical financial data trends and projects it 12 months into the future, automatically building comprehensive forecasts for operational P&L and balance sheet items, along with all of your key RealTime CEO metrics.

This eliminates the biggest source of headaches in the forecasting process – building the initial 12-month forecast (including the balance sheet items).

The software delivers your financial forecast without the need for accountants or Excel gurus. It allows business leaders to have a business conversation about the future while adjusting business assumptions with a few clicks or numerical adjustments.

Enabling Financial Forecasting

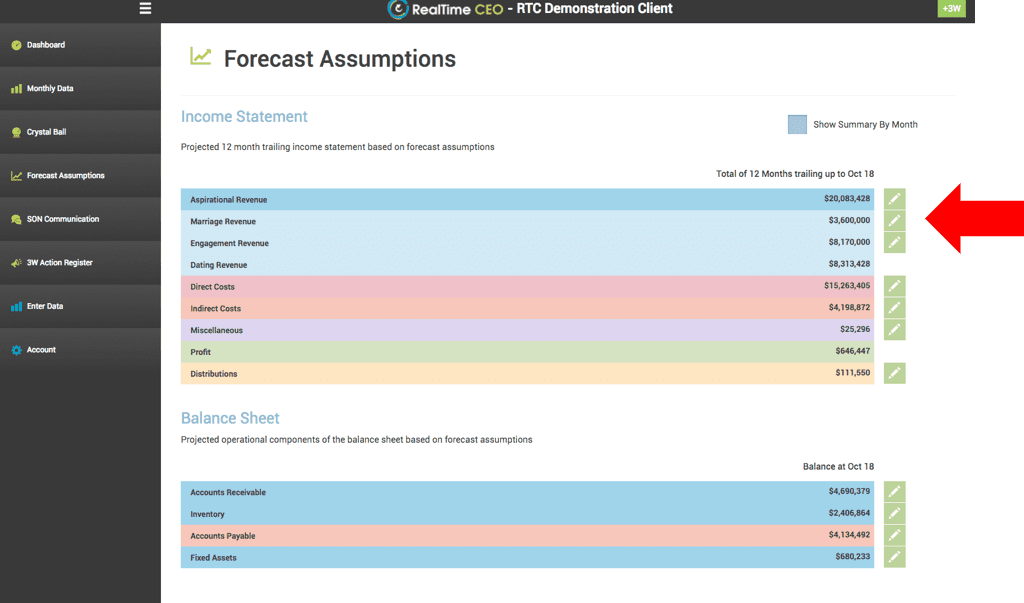

Access your financial forecast by clicking on the Forecast Assumptions option in the main navigation on the left.

The software will then allow you to select your 12-month revenue target, giving you the options of:

- Using your current trailing 12-month revenue

- Manually entering a target

- Selecting a percentage change from your current trailing 12-month revenue

Once you’ve determined the value of the revenue, you then have the option to set your monthly targets evenly or use the “seasonal shape” of the forecast by replicating the monthly totals from the previous year.

This provides the starting point for your business conversations about the landscape ahead.

Adjusting the Forecasting Assumptions

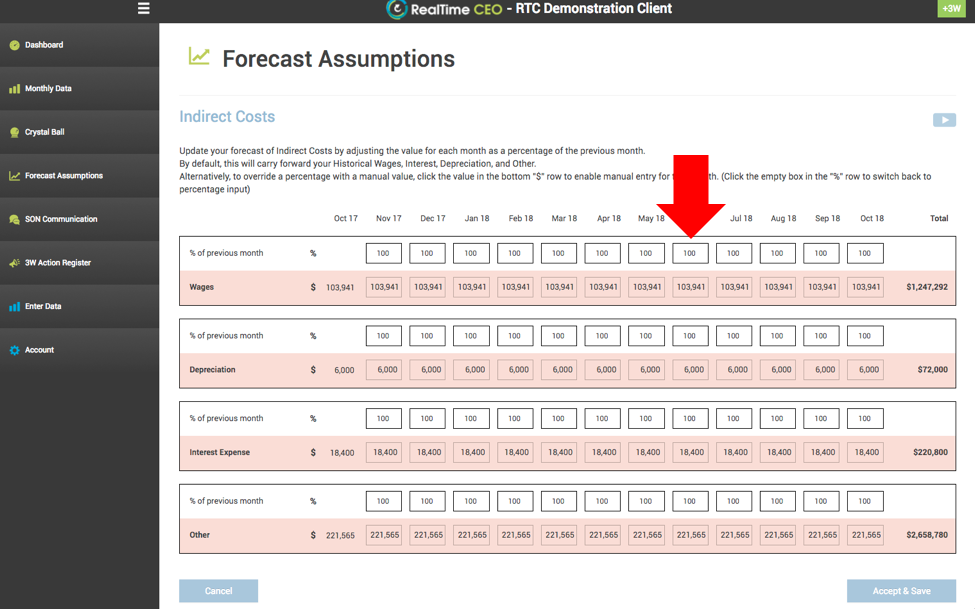

During your monthly SON communication business discussions, you can adjust your forecast as needed by selecting the category to edit.

Then, adjust specific months either by selecting a percentage change or by typing in a specific number.

Using Forecasting

Once you’ve enabled forecasting, you have the option to view it throughout the software.

Full Demonstration

Here is a complete video demonstration of how to use the financial forecasting module.

To get started, subscribe here.

Predicting the Future of Your Business

During most of my Vistage workshops, I ask the group the following question:

Who in your business is best qualified to predict and influence the future?

What do you think is the most common answer that I hear?

The CEO.

And I agree. I think that the CEO is best qualified to predict and influence the future, and that’s his job. (However, I am also asking CEOs to answer this question…)

What do you think is the second most common answer?

The sales manager.

I agree. The sales manager and sales team typically have the pulse of what orders will be coming in during the rest of the month or quarter.

The third most common answer is the operations team. They are the ones interfacing with the sales team about fulfilling future orders.

Do I ever hear that the CFO or lead accountant is the best qualified person to predict and influence the future?

Rarely.

Yet most CEOs assign control of the budget to the CFO.

If an accountant or a CFO is not the best person to predict the future, why do you make them the custodian of the budget? It’s flawed logic and you’re setting up the forecasting process to fail. (I don’t want to upset any accountants here; they should play a critically important role in this process, but it is unfair to expect them to be the custodians of the process if they are not the best qualified to predict and influence the future.)

Why do so many CEOs continue to support this flawed process?

When I ask this question, I get two answers back: One is that the forecast is about numbers, and they’re the numbers people so if they don’t do this, what will they do? The second answer is that they are the best at Excel!

Which of these answers is worse?

Both are bad; if you’ve selected the custodian of your future based on their Excel skills, you’re in trouble. (Excel skills are great for manipulating numbers that others input and influence, but not for determining key numbers based on future business events.)

And the very first mistake that most businesses make in forecasting is that the CEO assumes it’s solely about numbers and jumps into the numbers too quickly. Isn’t this why so many mid-market companies give up on forecasting altogether? When it’s never accurate, why waste the time?

As you’re reflecting on 2016 and thinking about changes you’ll make in 2017, consider revising your forecasting process. Here’s what I recommend to my Vistage groups and clients:

- Determine your core forecasting team – the people with the pulse of the future of the business

- Follow this monthly forecasting process

- Use SON communication to eliminate SILO mentality

- Work with your CFO or controller to input the numerical results into a 24 month rolling model

I’ve seen this process transform many CEOs’ ability to successfully predict the future of their businesses.

Merry Christmas!

Forecasting Fallacy – It’s Not About the Numbers

Financial forecasting is a standard activity at the enterprise level. Big companies create detailed monthly and quarterly projections including revenue, expenses and net profit. Public markets demand it.

So why do so few mid-market executive teams commit to an effective forecasting process? And I’m not talking about the standard back-of-the-napkin annual revenue and profit estimates that take about 5 minutes to create; I’m talking about engaging in the legitimate business process of projecting the numerical values of the business on a monthly basis for the next 12 months into the future.

Here are some of the most common excuses I hear:

- I can’t predict the future

- My accounting system won’t handle this

- Things change too quickly

- We used to forecast, but our forecasts were never accurate

- Our data isn’t ready by month-end

- We don’t have the bandwidth

- Our accountant handles the numbers

- I’m not the numbers person

The last two irk me the most. After working with over 1,000 businesses across the world over the past 15 years, I can unequivocally say this:

If you don’t understand your numbers, then you don’t understand your business.

It’s that simple.

Yet I’m consistently shocked at the sheer number of mid-market companies that fail to engage in an acceptable monthly forecasting process.

That’s one of my favorite Churchill quotes, referring to armies, battle and nations. And it’s just as relevant for businesses.

The problem I see with many businesses is that their leadership team thinks that planning is talking about taking a number that’s hard to understand and potentially irrelevant and placing in a graph or chart and voila – forecasting is done!

That’s not enough.

In my 12 years of speaking with Vistage and TEC groups through the world, I’ve had the unfortunate experience of seeing a handful of businesses fail when some of these failures could have been prevented by using an acceptable forecasting process.

But I’ve also had the good fortune of having some CEOs tell me, “Nick, we would have gone out of business if we weren’t using the 12-month rolling forecasting procedure you recommended to prevent a catastrophe.”

That’s rewarding.

But forecasting is difficult for most businesses, and the #1 mistake that businesses make (aside from NOT forecasting) is this:

When implementing a forecasting process, they jump into the numbers too quickly

How is that a problem? Isn’t forecasting about numbers?

Effective forecasting is about the process of discussing the following:

- How the business landscape has changed over the last 30 days

- How that will affect your business

- How your numbers are affected by #2

A few numbers dropped into a spreadsheet on a whim is not an effective forecasting process, but having the above discussions with your core leadership team, on a monthly basis, can be. I call this process SON communication.

The real key to financial forecasting is your monthly communication process. Fix this, and you’ll get incredible value from the process.

24 Month Rolling Forecasts

Do your company’s reporting methods guide you into the future or force you to look backwards? 24 Month Rolling Forecasts provide a powerful management technique that helps you predict and influence the future.

For over a decade I’ve had the privilege of working with businesses in the US, Australia, Canada, the UK and New Zealand, across a wide range of industries. Many of them have been very successful companies, led by shrewd CEOs.

However, when analyzing their financial statements and methods of budgeting, I am constantly surprised that so many companies continue to rely on Year-to-date measurement and annual budgeting.

While Year-To-Date (YTD) is the most common method of financial measurement, it is also the least effective. Likewise, even though annual budgeting is the most common format it is fundamentally flawed.

Today I’m going to introduce the concept of Trailing 12 Month Measurement (TTM) and 24 Month Rolling Forecasts.

Limitations of Year-to-date (YTD) measurement and traditional budgeting

YTD only measures performance over a full year once every year (at the end of the fiscal year). For the other 11 months it is measuring an incomplete year thereby exposing the user to seasonal variation.

Traditional budgeting is also flawed for many reasons:

- Only done once per year

- Focuses only on the income statement,

- Often driven by the CFO who is not necessarily the best qualified person in the business to predict and influence the future.

- Each month hours are wasted comparing variances between actual and budget. These variances may be simply that changes that have arisen during the year that weren’t visible when the budget was made. Even the best CEOs probably don’t have real psychic ability!

Consider this analogy:

Companies that budget their future for the next twelve months, without updating it each month, are like a car driver who stares at a spot 120 metres in front of them and continues to stare at the same spot until they reach it. Safe drivers know to keep their field of vision consistently forward.

Are you staring at a spot on the road and putting your business at risk? Or do you believe that business conditions are constantly changing and each month we learn new and valuable information about the road ahead?

Why is Trailing Twelve Month (TTM) and 24 Month Rolling more effective?

TTM is underpinned by the internal recognition that each month is the conclusion of a 12 month period. No month end is any more important than any other. By viewing the business this way, we remove the impact of seasonality. This is important because seasonality can create a veil that disguises trend changes.

24 Month Rolling forecasts have numerous advantages over traditional budgeting, not least is the ability to accommodate a rapidly changing landscape. If a business could confidently say their landscape only changed once a year, traditional budgeting would be fine, however, I have never met a business that could say that!

24 Month Rolling forecast provides you with trailing twelve months (TTM) figures plus projections for the next twelve months, in the one model. This gives you the best possible picture of your business performance, incorporating past, present and future.

Imagine if you could get inside a time machine to go forward in time 12 months… You could see where your company is at that point of time and look back to the “current date” with all the benefits of hindsight. And if you weren’t happy with your hindsight view of the current date, you could jump back in the time machine and return to the current data and do something about it in RealTime. 24 Month Rolling Forecasts provide that time machine!

RealTime CEOs learn from the past so they can influence the future by acting now, in RealTime.

In the next 24 Month Rolling post, I will expand on how to overcome predictable yet meaningless resistance to 24 Month Rolling forecasts.

If you would like to find out more, you can always contact us. We’d love to hear from you.

Stay Connected

Find out how much value you're creating by subscribing now.

Recent Posts

- ‘COVID-Zero’: Can We Afford It?

- Economics After COVID: Boom, Bust, or Something In-Between?

- Voodoo Finance For Sick Markets: Stock Prices During COVID-19

- Modern Monetary Theory

- Financial Forecasting – Introducing a Powerful New Module of the RealTime CEO Software

Categories

- Fiscal Focus (2)