Getting the Most Out of the SON Communication Process

If you’ve attended one of my workshops, you’ve heard me talk about the value of the SON communication process – a simple exercise that can dramatically improve your business.

(Here’s an introduction to SON communication along with a discussion of how to select your team and lead your SON communication meeting.)

One of the greatest values of your monthly SON communication meeting is that it can remove silo mentality. To do that, you must have a robust monthly leadership conversation. Some of you have asked for more guidance to ensure that your team has a lively discussion, so that’s the focus of this post.

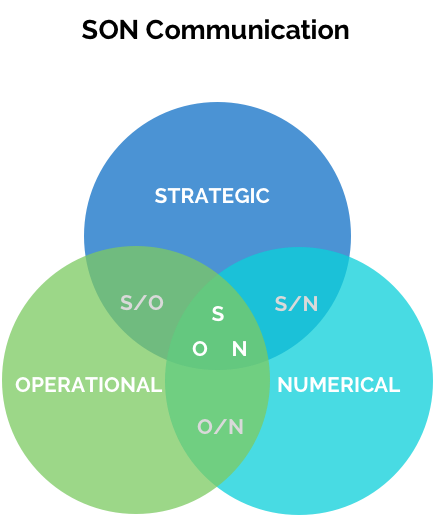

SON communication is built around 3 questions to challenge the strategic, operational and numeric changes happening around your business.

Question 1: “What information has come to light in the last 30 days that changes our view of the future?”

There is no fixed way to answer this question but try and resist going to the numerical too quickly. Keep the conversation at a higher strategic level. (Question 3 will give you plenty of chance to go numerical).

Below I have provided a series of bullet points to assist you in the early implementation of this process. As time goes on, make this list your own. Remove bullets that don’t relate to your business and add others that do. The bullet points are listed under 2 headings: things that impact demand for your goods and services and things that impact your ability to supply.

Demand Factor Questions

- Are opportunities increasing or decreasing? (This facilitates a discussion the size of the pie, or market size.)

- Is our market share changing? (Focuses on your slice of the pie.)

- Has our strategic marketing or tactical sales approach changed?

- Is our product/service mix changing?

- Has our market mix changed and are we considering new markets?

- Are there any opportunity to launch new products or services?

- Has our pricing landscape changed? (An opportunity to increase prices vs. pressure to discount.)

- Have we heard a “quirky” anecdote as to why our business has been preferred/differentiated from the competition?

- Have our existing or new competitors changed their approach?

- Have projects slipped back or come forward?

Supply Factor Questions

- Have there been any changes to our current or potential human resources?

- What is happening in our supply chain – availability / reliability / price?

- Have we changed any internal systems (i.e. has a mistake resulted in an improvement in internal systems to ensure it doesn’t happen again?)

Question 2: “How will our behavior change to create value or mitigate risk?”

Question 3: “What will be the numerical implication of these changes?”

Use the Crystal Ball feature of the RealTime CEO software to challenge possible actions identified during questions 2 and 3 of the SON discussion. This will ensure that you get the most out of your monthly meetings.

RealTime CEO Cash Flow

Fiscal Focus is the plain English measurement module of RealTimeCEO. In our Fiscal Focus blog we looked at the Fiscal Focus pyramid, which describes the two main business aims: to generate return and to generate cash flow. In this blog we will discuss cash flow, which is the lifeblood of your business. Some people say to me, “Cash flow’s fine, Nick, but what about profit? That’s what really important.” Well, let me put this analogy to you. Profit is like food to business, which is important. But cash flow is like oxygen. You can go without food for a while but how long can you go without oxygen?

So, if we accept that cash flow is vitally important, let’s look at an easy way to measure our cash flow. Each of the eight Fiscal Focus levers [insert link here] is going to either put pressure on your cash flow or take the pressure off. For example, if your suppliers will give you goods today which you don’t have to pay for until later, that will ease the pressure on your cash flow. Alternatively, if you provide goods to your customers today that they don’t pay for until later, that’s going to put pressure on your cash flow.

So, how do we measure the cash flow in our business?

Have a look at this video for more insight into Cash Flow.

Tracking cash flow using this method has two advantages: one, it’s a very easy way to track it; and two, it gives you specific information you will need in conversations with your bank. But this calculation is most powerful when done over a twelve-month period; don’t fall into the trap of tracking it on a year to date or part-year basis.

Having problems keeping track of your cash flow? Are you worried about the possibility of liquidity problems? We can provide you with all the information you need to measure your cash flow and show you ways to increase it. For more information, check out our app (coming soon on the home page).

You can also follow RealTimeCEO on Twitter or Facebook for updates on blogs and news items.

Tweet

Core Management Principle 3 – the ‘Crystal Ball’

Welcome back to our series of blogs on Core Managment Principles. We have already looked at ‘3W Accountability’ and this one discusses ‘Decision Validation’ or what we call the RealTimeCEO Crystal Ball.

“An expert is somebody who has managed to make decisions and judgements simpler by knowing what to pay attention to and what to ignore.”

– Edward de Bono.

Don’t you wish you had a Crystal Ball?

Making decisions is a vital part of a CEO’s job. By knowing how to separate the important impacts from the other impacts, you will make a better decision. But how can you possibly make a decision about the future using data from the past? There may be other factors, for example, political or emotional considerations. Have you ever found yourself with a decision to make that has outdated, incomplete or inaccurate data, with political and/or emotional overtones? You probably relied on the thing which has got you where you are today – gut feel. We’re not saying gut feel isn’t important, but it does occasionally send you down the wrong path and it can be tough to get back from there. You need a Crystal Ball, right? Our process works with your instincts by helping you to test them.

For every decision, you need to ask two questions:

- Should we do this?

- Can we do this?

The Should We? question can be answered by looking at Return on Operations (ROO). If the result of your decision makes your ROO stronger, then your reason for being will be stronger and you should do it. If the decision will result in your ROO being diminished, then you shouldn’t. For more information about ROO see our blog, RealTime CEO / Fiscal Focus – Return.

The Can We? question depends on what it will do to your business’s cash flow. Do you have enough cash flow to fund this decision without jeopardizing your future cash flow? If the answer is yes, then you can. If the answer is no, then you can’t. For more information on cash flow refer to our blog, RealTime CEO / Fiscal Focus – Cash Flow.

Should we/Can we? brings clarity to decisions that may have been hazy in the past. In other words it gives you a Crystal Ball.

If you would like further clarity on this subject or any of our other tools, check out our app on our home page.

Are You Riding the Wave or Creating Your Market?

In my Vistage workshops, I talk a lot about predicting the future. And in my last post, I outlined the process I use with CEOs to enable them to more accurately predict the future of their business.

I accept that it’s impossible to continually predict the future with 100% accuracy. But I’ve seen a lot of CEOs learn to predict their financial performance for the next 180 days with a high level of accuracy, even up to 90%. That’s not bad.

And it’s always fun to work with a growing business, when revenues are increasing, profits are increasing, and the celebration culture is off the charts! Yet sometimes, that growing revenue can deliver a false signal about your performance or the performance of your business.

How?

It’s important to understand what is causing your profitable growth. To do so, during your monthly SON communication meeting, listen carefully to the answers about your market changes, competitors and marketing and sales performance when you ask the question what information has come to light in the last 30 days that changes our view of the future?

Profitable growth is almost always a good thing for a business. It’s a result of overall demand increasing for your products or services. But dig deeper in each meeting and explore why the demand is increasing. Ask the following question:

Is my growth market driven, or is it due to the performance of our marketing and sales?

In growing markets, I see plenty of businesses that are growing profitable and creating happy owners and executives. But that growth is not always occurring because they are particularly well run businesses; they’re growing because their market is growing, and that opportunity is so big that it is pushing everybody with the market.

To use a surfing analogy, it was more about the wave than the rider.

If you’re riding a wave, life is good, but be careful about getting complacent in the good times; it can mask flaws in your business that could rear their ugly head when the market growth slows. Research your market to see how your growth compares to the overall market and your competitors. If you’re growing faster than both, you’re probably doing the right things. If you’re growing at 20% but the market is growing at 100%, you’re falling behind the competition. When that growth levels off, you could be in trouble.

If your market isn’t growing, or you’re growing faster than your market, then congratulations! You’re generating the growth from your own activities. That means that your slice of overall pie is getting bigger, and you’re taking market share from your competitors.

After you celebrate your success, talk about the reasons why you’re succeeding. Has your strategic marketing or tactical sales process changed? Marketing is planting and watering the tree, sales is picking the fruit – which is driving the growth? What’s happening on your pricing landscape? Do you see opportunity to increase your price because of your brand?

If you can identify the causes of your success, then double down on them to increase your rate of growth over the next 90 days. Your business will be stronger because of it.

And then look for the next wave to ride, and life will get even better.

Creating a Culture of Accountability

If I were to ask you the following question, what would your response be?

When something goes wrong in business, does it typically result from poor strategy or poor execution?

From my experience, there’s a ten to one ratio between these two.

And as you probably already know, the answer is poor execution. It’s a serious issue with many companies, so much so that there’s a saying that poor execution eats strategy for lunch; it doesn’t matter how great your strategy is, if your team doesn’t execute, then it all falls apart.

So why is it so common that execution is inevitably compromised?

It’s compromised when you fail to have two things:

- Accountability

- Responsibility

Establishing Accountability

In every turnaround consulting project that I performed earlier in my career, the first thing I focused on was instilling a culture of accountability. Without it, the turnaround was doomed.

As a turn-around consultant, I had a license to change things. Moreover, I had a responsibility to change things. Without change, the company would go broke. So people listened.

To begin creating the culture, I implemented what I call Integrated 3W Accountability. It’s a concept so simple that on the surface, many of you will dismiss it, or worse, you will think that you are currently doing it. And you may well be, but the vast majority of businesses that I have worked with are not.

Integrated 3W Accountability is the concept that every action has to have a what, a who and a when. That’s it.

Not very complicated, right?

As with many of the concepts I’ve implemented, it is not how simple it is, it’s how effectively you implement it.

Creating the Culture

The first action I would take was to bring together the leadership team for an open planning session. I’d kick off the session with a conversation about the positive – what are the things that we do well? What have we got here that’s worth saving? Then I would recognize that there were some things that were not done well, otherwise, we wouldn’t be in this position. But my focus now is about how we could do those things better in the future. It was important that we kept the conversation positive, even when we were talking about business weaknesses.

At the end of that conversation, the walls were always covered with flip-chart paper filled with a surprising number of great ideas!

After the meeting, I introduced the Integrated 3W Accountability concept. It’s easy to explain, but also very easy to fail to execute. Why is that?

- Some people will sandbag

- Some people will say that they’re too busy

Here’s the process I used to prevent this from happening:

- Have the team select five ‘whats’ that are going to be easy for people to commit to.

- Allow each person to define the when. This is important – allow them to own it! Do not override it unless there are extremely unusual circumstances.

- Clearly establish the non-negotiable rule that one of two things must happen by the when: Firstly, and preferably, you complete the action. If for some reason you cannot complete the action by the deadline, contact me beforehand and request an extension. What is not accepted is to sail through the deadline because you are too busy.

- Strictly enforce rule #3!

There will always be some people who will think that the rules don’t apply to them and will allow the deadline pass without completing the task or requesting an extension. Hold them accountable or let them go.

If you do not, the whole thing falls apart.

Enforcing rule #3 is the key. Do this, and you will begin to create the foundation for a “Culture of Accountability.”

SON Communication – A Process That Eliminates Silo Mentality

Every month I get to travel to different parts of the world to talk about a subject I am passionate about: creating value in business.

There are only two things that matter in businesses for creating value – people and cash flow.

Everything else is secondary.

Without a shadow of doubt, the most common mistake that I see in business (that destroys value and compromises so much potential) is silo mentality. You know what I’m talking about, don’t you? The attitude of not sharing information and building barriers to protect your turf?

Silo mentality destroys value in your business. When your people aren’t communicating effectively, your business is failing at one of the most important drivers of value.

Managers and executives commonly create complexity in their business. It’s natural for many. Yet simplicity is what they should be striving for. I talked about that in my last post.

So how do we remove it?

After working with over 1,000 businesses across the globe, I’ve developed a practical process that can eliminate silo mentality.

It’s called SON communication.

SON communication is a process that costs you nothing, but if you do it effectively, you’re instantly going to increase value in your business.

How SON Communication Eliminates Silo Mentality

SON communication is a process to drive a monthly conversation amongst management teams to get them to raise their horizon and address each business issue in strategic first, operations second and numerical third.

It’s about having each and every member of the leadership team participating, understanding and contributing to all three “circles.”

With SON communication, it is not acceptable for anybody on the leadership teams to err in one of those three values. The CFO can’t only focus on numbers. The creative people can’t delegate the numbers conversation to the CFO. (If you don’t understand your numbers then you don’t understand your business.)

You need to be able to engender that conversation amongst the leadership team. And you need to do it in a manner that contributes to the views, in other words, you need to be able to disagree but without being disagreeable.

The most robust leadership conversations that you could have are the ones where you have a variety of opinions, because quite frankly if you want to agree, there is no point in having more than one person in the room. So I want leaders to take different views, but I want them do it in a manner that they are not going to end up punching each other.

This helps to break down the silos in your business. When everybody is trying to make themselves look intelligent, you’ve got fences and silos.

SON communication pushes the circles together.

Now, it’s important to understand you never want the circles to totally overlap. You need these experts in the leadership team to be experts in the field, that’s why they are there. But you also need them to able to talk to each other, so you need a common ground.

With that said, the most frustrating hybrid is the operations and numerical, because not only are these two different languages, but they are now competing to get the attention of the CEO from very different angles. But I never wanted a bilingual, I wanted all three. I want each and every member of the leadership team to participate, understand and contribute to strategic, operational and numerical. That’s what SON communication is.

Selecting Your SON Communication Team

If you have someone in your leadership team who is saying, “I don’t know, I don’t have a crystal ball,” or “these things changed too quickly, I can’t tell,” then that person doesn’t belong on the leadership team.

That person might be an astonishingly effective “today operator,” so let them go and manage “today.” And if that means that your leadership team shrinks to 2 or 3 people for SON communication, that’s fine! So long as these 2 to 3 people are talking to the others before they come to the table to collect information that they might find interesting about tomorrow.

So take the opportunity to go back and challenge whether your leadership team is actually a leadership team, or whether they are just “today operators.” It might influence how effectively you have these conversations in future.

Your best determinant of whether you have silo mentality in your business if is you hear, “It’s complicated, you won’t understand.”

I’ll end with one of my favorite quotes from Albert Einstein:

If you can’t explain it to me simply, you don’t understand.

The Simple Way to Improve Your Business

Good executives and managers are always looking for ways to improve their business and there are plenty of consultants around the world trying to help them.

These consultants invest in training programs, education, research, case studies and in creating their own intellectual property.

You’re probably familiar with many of the ridiculous management fads over the past few decades: six sigma, business process reengineering, matrix management, management by consensus, core competency… and so forth.

These techniques were all developed by intelligent people and implemented by top-level leaders of very successful businesses. On the surface, they should have worked, right? But did they? Often, the companies that implemented these ideas lost value. And (other than the most obvious reason of sucking the productivity out of their workers) there is one common reason.

Complexity.

Each of these ideas added layers of complexity into the business. Consultants and managers created entire new languages that few in the business understood. Precious time was spent on learning how to add complication to the business, instead of simplifying the business.

I first experienced this at age 25 when I was dropped in the deep end and tasked with running a branch of a software company. It was terrifying; every single person that worked for me was older than me, I’d never run a company and I knew nothing about software.

Have you ever noticed what’s unusual about the IT industry?

The vast majority of information that comes out of an IT person’s mouth makes no sense to the rest of the world. They speak in absurd babble and jargon – it’s an industry that’s riddled with TLAs and EFLAs .

TLAs – Three Letter Acronyms

EFLAs – Extended Four Letter Acronyms

Nobody else in the company spoke this language. So I introduced a rule on day one which was critical and possibly the luckiest and smartest thing I have ever done in my career:

The “plain English” rule.

If you wanted to bring an issue to the leadership table, you had to bring it in plain English. You couldn’t bring it in jargon, because quite frankly I had no idea what you were talking about. Also, what I learned very quickly was that it wasn’t just me that didn’t understand; members of my team didn’t always understand each other either.

Complexity creates confusion and silos. It saps productivity.

Simplicity creates understanding and collaboration. It improves productivity.

Plain English communication has now become a central tenet of RealTimeCEO.

Eliminate the jargon in your business and use “plain English” and you’ll be amazed at the results. It’s that simple.

(The cartoon is courtesy of the Plain English Foundation. They provide training and workshops for businesses in Australia for simplifying corporate communications.)

Core Management Principle 5 – RealTime Planning

“He who fails to plan, is planning to fail.” – Winston Churchill.

Winston Churchill was referring to armies, battles and empires when he said this but it’s equally relevant for businesses.

Businesses need to forecast in order to plan but the forecast process for many businesses is weak and unreliable. They use historical data to analyse the past then work out the future later. But it’s not just about forecasting, we want to create a management culture that improves a number of different areas in your business by providing:

- Strategic conversations – we need a forum for strategic conversations across the management team

- Instant & valuable management reporting – the traditional accounting process is too slow at getting the next lot of figures out and is difficult for executives to understand.

- Better sales management mechanism – managing a significant sales team is complicated and anything that helps improve that process is worthwhile.

- Better forecasting – Better forecasting is essential for predicting and influencing the future. In fact, if you improve in the first three areas, it will help to improve your forecasting anyway.

For many businesses the traditional budgeting process is a long and frustrating one. It is driven by the CFO and is only completed once each year, which doesn’t allow for changes in the landscape. The process is based on the income statement, which is not always understood by those who receive the budgets.

In RealTime Planning we ask the following questions:

Q. Who in your business is best qualified to predict and influence the future?

A. The CEO, followed by sales people and operational teams.

Q. How often is the landscape ahead of your business changing?

A. Often enough that you need to measure each month, rather than annually.

Q. Is there a better way to measure the past?

A. Trailing 12-Month or RealTime 24-Month Rolling

Q. Is there a better way to plan & forecast the future?

A. RealTime 24-Month Rolling

For more information take a look at our blog, 24-Month Rolling Forecasts or contact us for more information and assistance.

You can also follow us on Facebook and Twitter.

Core Management Principle 1 – 3W Accountability

Welcome to our series of blogs looking at the Core Management Principles. The first of which covers what I call 3W Accountability

“The price of greatness is responsibility”

– Winston Churchill.

I like this quote, not because of the words that are in it but because of the words that are not in it. Churchill did not say the price of greatness is intellect or hard work or turning up to work on time or being a nice guy. It’s about taking responsibility. When I was 25 years old I was asked to take over and turn around a software company that was doing badly. I was terrified. Nearly everybody in the company was older than I was. My first major action was to gather all the key executives together. These days we would call it a “strategic planning” session. But back then I just called it a “what the hell am I going to do?” session.

I found the executives had plenty of knowledge in their own areas and we came up with some excellent ideas that we made into a plan. We needed to formulate those ideas into actions and everyone needed to play their part.

How do we make people accountable?

The answer is by using a process that is very simple. It’s called the 3 Ws. Each time you define an action, attach the 3 Ws to it – What, Who and When. Pretty simple, isn’t it? What is the action? Who is responsible for completing that action? When will the action be completed? The group defines the What and the Who and the Who defines the When. You as the CEO set an expectation that one of two things will happen by the When. One, the action will be complete; or two, if the person cannot complete the action by the deadline, they come back to group and ask for an extension, prior to the deadline.

So, we come back together for the next meeting and go through the actions we agreed on last time. Most people have completed their actions. But one person hasn’t. What happens next is critical. I stop the meeting. I say in a quiet but firm voice, “That is not an acceptable answer. That answer has disrespected this group. We made an agreement a week ago that one of two things was going to happen by the When. It’s not acceptable.” Suddenly the room is deathly silent. Everyone will anxious to complete action items next time. And you can be sure that ten minutes before your next meeting you’ll have a flood of people coming to your office and asking for an extension.

And that’s ok. Because what you’ve now learnt is who in your business is overwhelmed, who in your business is not able to meet deadlines, who in your business is taking you for a ride, and those who are the valid contributors in your business who will help dig us out of this hole. And believe me, those things are really handy to know. I did turn that company around and I’ve used the 3Ws technique for every turnaround that I’ve done since. It works.

Now that you have got your people to be accountable, how about knowing which of the actions will have the most impact on your business. Come back next time to find out when we look at Sensitivity Analysis.

The next in the series of Core Management Principles looks at an introduction to Fiscal Focus.

Want to know more about the 3Ws or any of our other tools, just contact us – it’s easy!

Core Management Principle 2 – Fiscal Focus

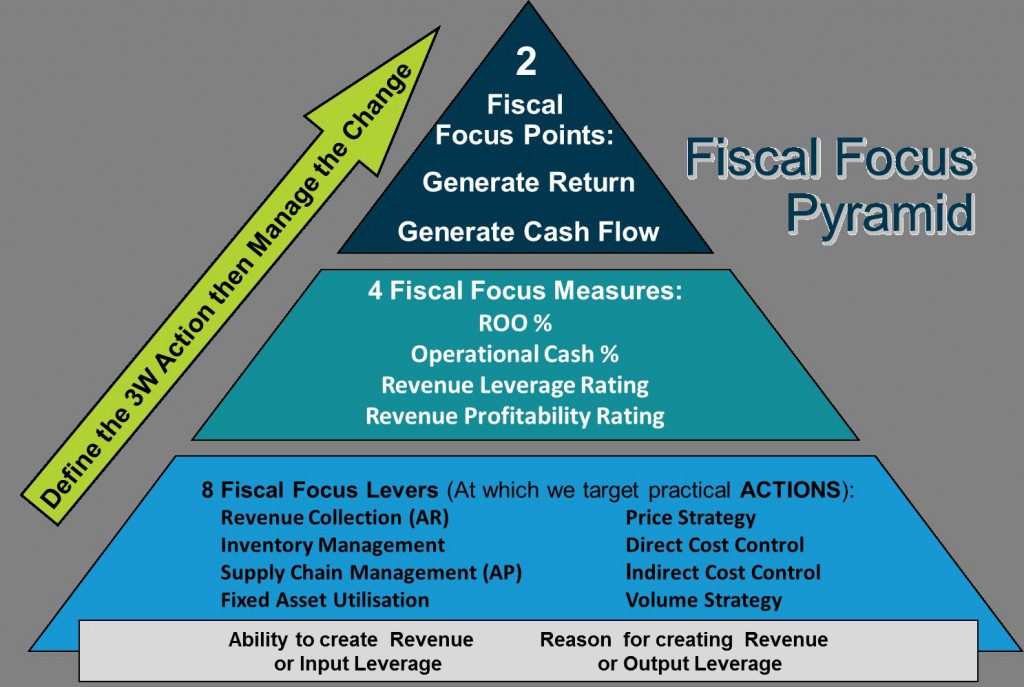

Do you and your executives truly understand all the numerical information provided by your accountant? In my experience, most don’t. But with Fiscal Focus, you can!

Having a background in accounting, I’m lucky enough to understand double entry bookkeeping. Traditional accounting methods such as this are handy for reporting business data to agencies like the tax authorities. But the way the information is presented to reporting agencies is not always the most useful format for business leaders.

One of the issues I see everywhere is that business people who rely on financial data for decision–making have no prior exposure to these kinds of reports. Or if they have, they don’t understand them. Accountants provide reports such as Profit and Loss Statements (P&L) and Balance Sheets. The P&L doesn’t require a lot of training to understand it. That said, most managers tend to rely on the two numbers at the top and bottom of the report being revenue and profit. The Balance Sheet, containing asset, liability and equity figures, is harder to decipher for managers who aren’t trained in accounting.

After moving into management, I realised that executives were highly capable of their particular tasks but often didn’t understand the wider ramifications of their actions. This resulted in people acting as silos with all the problems that entails. By introducing a plain English measurement, which could be understood by managers without a financial background, I was able to demonstrate the impact of my team’s actions on the entire performance of the business.

This morphed into Fiscal Focus – a plain English set of numbers that will help any business, of any size, anywhere in the world, in any industry, to understand their true performance as well as actions impacting the business’s performance.

The diagram below depicts the Fiscal Focus Pyramid. At the top are two main indicators of the health of the business. These indicators are born from two fundamental questions that all entrepreneurs should ask:

- Is the return on investment commensurate with risk?

- Have we generated enough cash flow to continue being an entrepreneur?

Underneath are four mathematical equations that enable us to determine the strengths and weaknesses of any size or kind of business.

On the next level we have eight fiscal focus levers – things that executives can change to influence the performance of the business.

Fiscal Focus Pyramid

Not only does fiscal focus provide a clear insight into the strengths and weaknesses of a business, it also uses a mathematical process called sensitivity analysis. This enables you to determine which one percent change to any of those levers will have the most profound impact on the business’s strengths and weaknesses. Moreover, it will clearly show what is most effective at creating value and improving the cash flow performance of the business.

How much easier would it be to make business decisions if you knew how effective the changes would be before you made the decision?

Our next blog on Fiscal Focus will discuss how this thinking can be used to validate decisions using the simple yet powerful “Should We? Can We?” decision validation technique. You can view our Scenario Builder here!

Want to know more? Then contact us – its easy

Stay Connected

Find out how much value you're creating by subscribing now.

Recent Posts

- ‘COVID-Zero’: Can We Afford It?

- Economics After COVID: Boom, Bust, or Something In-Between?

- Voodoo Finance For Sick Markets: Stock Prices During COVID-19

- Modern Monetary Theory

- Financial Forecasting – Introducing a Powerful New Module of the RealTime CEO Software

Categories

- Fiscal Focus (2)