J Curves – Other Considerations

Welcome back to RealTimeCEO. In our series of blogs on J Curves, we’ve discussed J Curve Management, the Three Phases, and the 5 Management Rules. But there are some other issues to be aware of with J curves that we will cover here.

First of all it’s important to remember that questioning a J curve today doesn’t necessarily mean you are questioning the original decision. If it’s to find a scapegoat you can shout at, it’s going to be a waste of time. Revisiting the original decision is far more productive if you do it as a learning exercise to improve your future performance. It’s quite possible that it was the right decision yesterday to make the J curve investment. But it’s also possible that it’s the right decision today to get out of it because the landscape has changed. So the key issue is to look at your landscape today to determine whether the investment is still going to deliver value and make decisions with that in mind.

Is it possible to slip backwards on a J curve? Yes, it is; these are called W curves. They progress from phase one to phase two but then fall back again. W curves need to be managed as you would manage any other J curve in phase one.

Can a J curve be macro and micro? Yes, executives at different levels through the business can manage J curves. The CEO is responsible for the company-wide macro register, containing investments that will have a profound impact on the business. But we also encourage the establishment of divisional J curves, overseen by divisional managers, for micro investments.

Costs of J Curves

There are two costs associated with J Curves. The first cost is pretty obvious. If they are managed badly you will lose cash flow, return and profit.

The second cost, executive headspace, is less obvious. If you ask your executives to juggle too many at one, some or all of those J curves will hit the ground. Your executives will create more value for your business if they do a fewer number of things well, rather than a number of things badly.

“A weak strategy well executed will inevitably outperform a strong strategy poorly executed”

Nick Setchell

The impact of J Curves

The impact of J curves can be broad. Obviously J curves can impact positively or negatively across your business. If you implement a J curve well, you will build cash reserves and all the benefits associated with that. It will have a positive impact on your business. On the other hand, if you implement or manage J curves poorly you’re likely to lose potential and never get the full reward for your entrepreneurial flair. Things will fall through the cracks. If you implement or manage J curves really badly, you are in real danger of bankruptcy. Review your J curve register regularly to make sure this doesn’t happen to your business.

The Cost and Impact of J Curves

The identification, prioritisation and management of J curves is the single most important determinant of entrepreneurial success. Would you like to manage your J curves better? Contact us; we’d love to hear from you.

J Curves – 5 Management Rules of J Curves

J Curve investments are a strategic decision to spend money today to receive a benefit tomorrow (in the future). We make these investments because we realise that the short-term financial loss is offset by the benefit it brings to your business in the medium to long term. Here at RealTimeCEO we believe in the importance of managing your investments well. To help your business do this we created a framework that we discussed in our last blog, J Curves – 3 Phases. Part of that framework is our list of 5 Management Rules of J Curves.

As the CEO, your role is to manage the macro j curves, investments that have a major impact on the overall business. As we noted in our blog, The Perfect Skill Mix of a CEO (insert link), the two main components of the CEO’s role are to create value and to mitigate risk.

Here are our 5 tips for managing J curves effectively:

1. Minimise the depth and breadth of the valley.

As we illustrated in J Curves – 3 Phases, the valley is the time between your initial outlay and when the project starts making money. It will inevitably end up being deeper and wider than you imagined at the start of the project. This rule is important for mitigating risk. We want our executives to come to us with innovative ideas. The executives naturally want the CEO to adopt their ideas and will place more emphasis on the upside of a project in order to sell the idea. As the CEO you need to be able to assess the costs as well as the benefits and do everything in your power to limit the size of the valley. Twice as long and twice as wide as you originally thought – keep that in mind.

Manage and attempt to limit the depth and breadth of the valley

2. Don’t become emotionally involved.

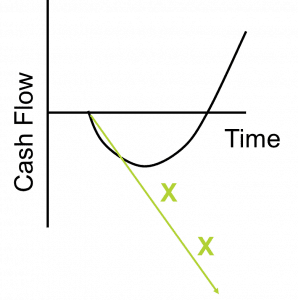

One of the toughest things about being a CEO is not becoming emotionally connected to your investments. CEOs must have passion and enthusiasm but they also need to understand the implications of each of their decisions. If you hear yourself, or one of your executives referring to it as a pet project, be wary; that’s a classic indicator of an emotional connection to the project. And there’s another part of our business that is filled with emotion – our people. Have you ever hired someone who had a fantastic resume and interviewed really well, only to realise they’re not adding value to your business? This employee could in fact be sucking resources out of your business and become a “flat liner”, continuing to draw the same amount of resources or even worse, a “ski slope” type of J curve that starts to suck even more out of your business. Once a large amount of money has been spent on an investment, it can be hard to let go. But if the investment is a ski slope, you need to recognise that fact and get out of it before you waste any more money on it.

Do not become emotinoally connected to the J Curve

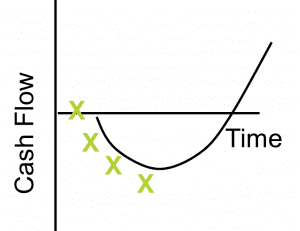

3. Don’t take on too many J curves at once.

While J curves are in phase one, they are sucking resources out of your business. No matter how many brilliant ideas you and your executives have, it makes no difference if the drain on your resources is going to send you broke. When you’re preparing to embark on a new J curve, ask yourself the following questions:

- · Is the investment strategically beneficial to your business?

- · Is now the right time?

And don’t worry about your executives getting offended if you say no. Just be sure to communicate to them that the time just isn’t right for their idea.

Do not take on too many macro J Curves at once

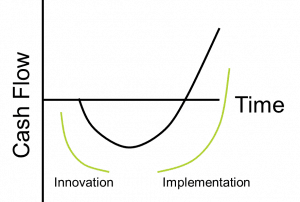

4. Have and manage a plan to move from phase one to phase three as quickly as possible.

Have a plan that enables you to move the J curve from phase one, through phase two and finally to phase three. There are different resources required for the three phases of the J curve. The people required for the investment and the catch up phase are the innovators, people who conceive the ideas and are able to promote them. But you need a different set of skills to drag the project from the bottom of the valley to the blue sky. These people are implementers. Ideally these roles should overlap and they can do this successfully if the issues have been effectively documented, communicated and procedures for them have been written. Be careful of innovators who are reluctant to let go of their “baby” or are ready to drop their J curve while it’s still progressing, in favour of the next big thing.

Have and manage a plan to move from phase 1 to phase 3 as quickly as possible

5. Establish a J Curve register.

Create a list of all the J curves you currently have, with documented updates on their progress. Excel is handy for this but you can do it elsewhere if you prefer. Your J curve register should include the following:

· What the J curve is

· When it started

· The progress on this J curve

· Money in

· Money out

· The net position of the J curve

· 3W action management (insert link)

One of the things we commit to with a J Curve register is to review and update the register regularly, at least once a month. Put it on your agenda for monthly management meetings and discuss each J curve. This will help you identify any issues, such as:

Do we have too many J curves on our register?

Have any of our J curves stalled?

Are any of your J curves turning into ski slopes?

Can we help you with managing J curves in your business? Contact us at RealTimeCEO for some specialist advice.

J Curves – 3 Phases of J Curve Management

In our previous blog J Curve Management, we discussed how important it is to your business to manage J curves well. On your journey through time you look out over the horizon and you come up with an idea that you know is going to make your business stronger in the future. But you also understand that to implement and get value out of that idea, you need to take a step back before you can take any steps forwards.

The 3 Phases of a J Curve

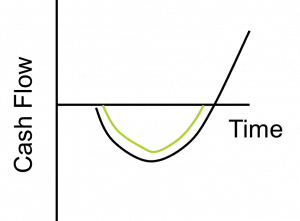

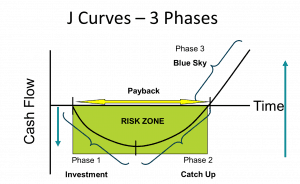

This diagram shows why it’s called a J curve. The black curve represents the investment; it sucks the cash out of your business for an amount of time we call the risk zone, before coming back up to its starting point and eventually surpassing it. The diagram also shows you the three phases in the life of a J curve:

J Curve Phase 1, the Investment phase –

This phase starts at the beginning of the project and ends at the bottom of the valley. This phase has two main characteristics. Most investors understand the first one because it’s the most painful. This is where you write out the significant cheque to make the investment. The second characteristic is sometimes hidden and often ignored. But ignoring this issue can be dangerous. We call it cash flow bleeding when, even after you’ve paid the initial investment amount, the project is losing more money than it is making. This causes a drain on your cash flow. At some point the money coming in will equal the money going out. This point starts at the bottom of the valley and marks the transition to Phase 2.

J Curve Phase 2, the Catch Up phase –

In phase 2, the project is still cash flow negative over the life of the project but it’s beginning to catch up. It’s now bringing in more money than it’s paying out. Our ultimate objective is for the project to reach a point where you’ve made more money over the life of the investment than you have paid out. This point brings us to Phase 3.

J Curve Phase 3, the Blue Sky phase –

When your project has delivered more to your business than it has cost, you have achieved the future benefit you originally invested for. You have become stronger today than you were yesterday as a result of that j curve investment.

The yellow arrow represents a calculation done by many businesses, which is to assess the length of time it will take before you are paid back for the amount invested. But there is much more to the investment than a single payback timeframe. It’s more important to understand how much cash is going to be sucked out of your business by this investment. This is why we refer to it as the risk zone. There are lots of things that can happen in your business while your J curve is in the risk zone. Any number of these can cause the project to stall, leaving you with nothing but wasted time and money.

Don’t let your J curves stall. Contact us to find out how we can help you manage your J curves to create the most value for your business.

J Curve Management Framework

In a previous blog, What are J Curve Investments?, we introduced the concept of a strategic decision to spend money today in order to gain a benefit in the future. In today’s blog we discuss how we can manage J Curves to drive business growth.

So, why do you need to manage J Curves?

J Curves for midmarket companies (larger than $1m and smaller than $100m) are broadly defined as any decision to spend money today where the benefit will not accrue until tomorrow or the future. You recognize that the short-term financial loss from these strategic investments is offset by the medium to long-term benefits to your business. At RealTimeCEO, we’ve analysed and worked with over a thousand businesses around the world and every single business in every single industry has J Curves in it. This makes the management of J Curves absolutely critical.

“The identification, prioritisation and management of J curves is the single most important determinant of entrepreneurial success.”

– Nick Setchell

Some J Curves that you need to identify in your business could be decisions such as:

- new product line

- new access to market strategy

- new equipment purchase

- new staff hire

- new business premises / opening other premises

- moving manufacturing overseas

- acquiring competitors.

We have designed a framework to help CEOs identify, prioritise and manage their J Curves. This framework is made up of:

- Three phases of a J Curve

- Measurement of J Curves

- 5 Rules for management of J Curves

- Other issues to consider

- Broad impact of J Curves

Stay tuned for our next three blogs where we provide more details on each of these aspects of the framework. Or for a personalised plan tailored to your business, contact us. We’d love to hear from you.

J Curves – The Risks

In our last posting on J Curves, we discussed ownership of J Curve investments and the problems involved if ownership is not managed effectively. Now I am sure you all realize that there are other risks associated with J Curves, so what are they?

No J Curves

Whenever I come across a company with no J Curve investments, I know I’m seeing a company that isn’t going to stay in business for the long haul. How can you adapt to the constant changes in the market (opportunities and threats) without J Curves?

Failed J Curves

When a company has a J Curve that fails, the financial losses and/or negative publicity can damage the business, sometimes fatally.

Too many J Curves

Even forward-thinking companies, seeking to innovate and stay ahead of the market, can have difficulties with too many J Curve investments. Having too many J Curves at once can sink a booming company.

When Rolls Royce, a company known for engineering and quality, declared bankruptcy in 1971, most of the blame was attributed to the technical problems of the RB-211 jet engine. Using lightweight carbon fibers in the fan blades to reduce engine weight caused the blades to shatter when hail or birds were sucked into the seven-foot fans. Deadlines were missed and production costs skyrocketed – common occurrences with J Curve investments. Despite the issues with this one engine (which, in the next ten years became one of the world’s most popular jet engines), the biggest problem was the company having too many costly developments running simultaneously. At the time of Rolls Royce’s bankruptcy, almost forty percent of its employees were working in engines that were not yet profitable.

Too many J Curves was a major factor in the company’s bankruptcy.

J Curves are vitally important to a company, however too many, too few or failed J curves can be fatal.

By properly managing your J curve investments, you can eliminate much of this risk.

Come back for my next post, when I’ll start to share my rules for managing J Curves. In the mean time, you can find out more by contacting us. It is easy.

J Curve Investment Ownership

In our previous blog, we looked at “What are J-Curve Investments?”. Today we would like you to think about your own J Curve investments and consider the following:

- Are you able to name the person in charge of each one?

- Is a single person responsible for managing and tracking their progress, and for measuring results and ensuring they don’t drastically damage the company?

- Do you have one person who is responsible for overseeing ALL of the J Curve investments?

In many mid-market companies (companies between $1 MM and $100 MM in revenue), rarely does a single person own this responsibility. Sometimes the responsibility is shared by a group of executives. This can work because mid-market CEOs and their leadership teams intuitively understand when they’re taking on J Curves.

But most mid-market companies don’t have a formal process for evaluating and managing strategic investments. Nor do they usually measure and track either the performance of the J Curve as an independent entity, or its impact on the business as a whole.

Should they? Absolutely!

Mid-market CEOs need to understand firstly, how many J Curves the company has, and secondly, the current status of each one. As well as the impact the investments have on cash flow, return and profit. They also need to appreciate the hidden cost of J Curves which is the amount of “executive head-space” that is absorbed. This cost is of course the opportunity cost of the other valuable tasks the executive could be completing.

Tune in next time when we’ll look at the risks involved in J Curve investments.

Want to know more? Just contact us!

What are J Curve Investments?

The old adage tells us that you have to spend money to make money.

J Curve investments are strategic decisions to spend money today to receive a benefit tomorrow. J Curve investments result from decisions to incur a short-term financial loss, which will be recovered in the future. The long-term benefits should outweigh the cost of the initial investment.

As I have indicated on the J Curve Management introductory page, every business has J Curves; some examples include:

- Adding a new product line

- Accessing a new market

- Hiring new staff

- Purchasing new equipment

- Opening a new location

- Moving manufacturing overseas

- Investing in R&D

- Acquiring competitors

J Curve investments can be classed as ‘macro’ – having an impact on the entire business, or ‘micro’ – having an impact on part of the business.

How important is it to properly undertake and manage J Curves? As I see it, the key to entrepreneurial success lies in identifying, prioritizing and managing J Curves.

In my next post on J-Curves, I will discuss the importance ‘Ownership of J-Curve Investments’

If you would like to find out more, you can always contact us. We’d love to hear from you.

Stay Connected

Find out how much value you're creating by subscribing now.

Recent Posts

- ‘COVID-Zero’: Can We Afford It?

- Economics After COVID: Boom, Bust, or Something In-Between?

- Voodoo Finance For Sick Markets: Stock Prices During COVID-19

- Modern Monetary Theory

- Financial Forecasting – Introducing a Powerful New Module of the RealTime CEO Software

Categories

- Fiscal Focus (2)