Core Management Principle 3 – the ‘Crystal Ball’

Welcome back to our series of blogs on Core Managment Principles. We have already looked at ‘3W Accountability’ and this one discusses ‘Decision Validation’ or what we call the RealTimeCEO Crystal Ball.

“An expert is somebody who has managed to make decisions and judgements simpler by knowing what to pay attention to and what to ignore.”

– Edward de Bono.

Don’t you wish you had a Crystal Ball?

Making decisions is a vital part of a CEO’s job. By knowing how to separate the important impacts from the other impacts, you will make a better decision. But how can you possibly make a decision about the future using data from the past? There may be other factors, for example, political or emotional considerations. Have you ever found yourself with a decision to make that has outdated, incomplete or inaccurate data, with political and/or emotional overtones? You probably relied on the thing which has got you where you are today – gut feel. We’re not saying gut feel isn’t important, but it does occasionally send you down the wrong path and it can be tough to get back from there. You need a Crystal Ball, right? Our process works with your instincts by helping you to test them.

For every decision, you need to ask two questions:

- Should we do this?

- Can we do this?

The Should We? question can be answered by looking at Return on Operations (ROO). If the result of your decision makes your ROO stronger, then your reason for being will be stronger and you should do it. If the decision will result in your ROO being diminished, then you shouldn’t. For more information about ROO see our blog, RealTime CEO / Fiscal Focus – Return.

The Can We? question depends on what it will do to your business’s cash flow. Do you have enough cash flow to fund this decision without jeopardizing your future cash flow? If the answer is yes, then you can. If the answer is no, then you can’t. For more information on cash flow refer to our blog, RealTime CEO / Fiscal Focus – Cash Flow.

Should we/Can we? brings clarity to decisions that may have been hazy in the past. In other words it gives you a Crystal Ball.

If you would like further clarity on this subject or any of our other tools, check out our app on our home page.

Core Management Principle 2 – Fiscal Focus

Do you and your executives truly understand all the numerical information provided by your accountant? In my experience, most don’t. But with Fiscal Focus, you can!

Having a background in accounting, I’m lucky enough to understand double entry bookkeeping. Traditional accounting methods such as this are handy for reporting business data to agencies like the tax authorities. But the way the information is presented to reporting agencies is not always the most useful format for business leaders.

One of the issues I see everywhere is that business people who rely on financial data for decision–making have no prior exposure to these kinds of reports. Or if they have, they don’t understand them. Accountants provide reports such as Profit and Loss Statements (P&L) and Balance Sheets. The P&L doesn’t require a lot of training to understand it. That said, most managers tend to rely on the two numbers at the top and bottom of the report being revenue and profit. The Balance Sheet, containing asset, liability and equity figures, is harder to decipher for managers who aren’t trained in accounting.

After moving into management, I realised that executives were highly capable of their particular tasks but often didn’t understand the wider ramifications of their actions. This resulted in people acting as silos with all the problems that entails. By introducing a plain English measurement, which could be understood by managers without a financial background, I was able to demonstrate the impact of my team’s actions on the entire performance of the business.

This morphed into Fiscal Focus – a plain English set of numbers that will help any business, of any size, anywhere in the world, in any industry, to understand their true performance as well as actions impacting the business’s performance.

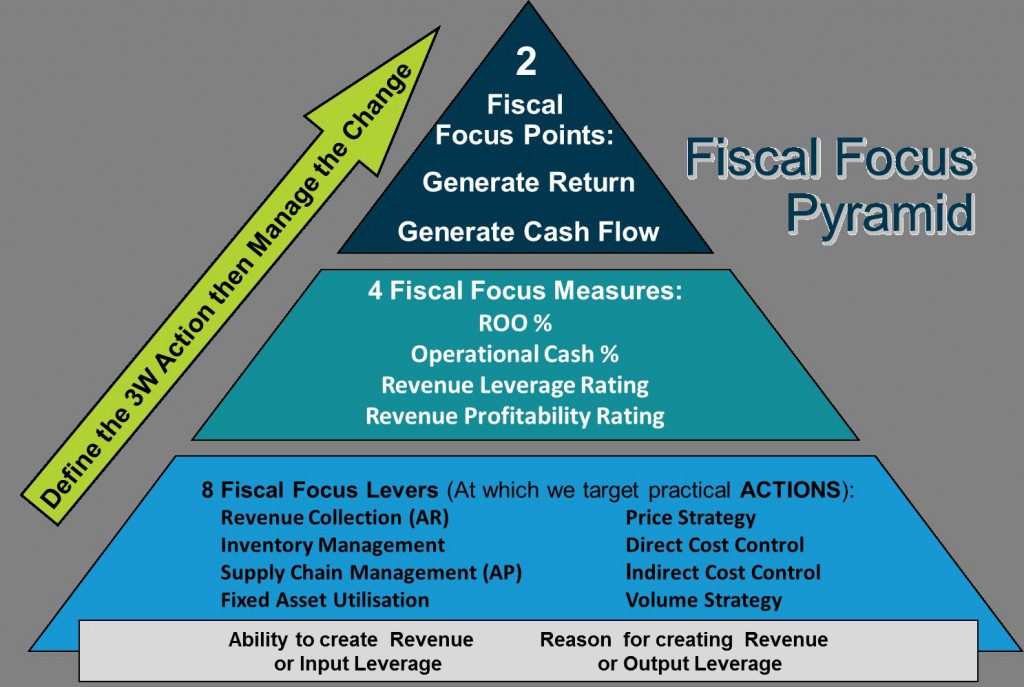

The diagram below depicts the Fiscal Focus Pyramid. At the top are two main indicators of the health of the business. These indicators are born from two fundamental questions that all entrepreneurs should ask:

- Is the return on investment commensurate with risk?

- Have we generated enough cash flow to continue being an entrepreneur?

Underneath are four mathematical equations that enable us to determine the strengths and weaknesses of any size or kind of business.

On the next level we have eight fiscal focus levers – things that executives can change to influence the performance of the business.

Fiscal Focus Pyramid

Not only does fiscal focus provide a clear insight into the strengths and weaknesses of a business, it also uses a mathematical process called sensitivity analysis. This enables you to determine which one percent change to any of those levers will have the most profound impact on the business’s strengths and weaknesses. Moreover, it will clearly show what is most effective at creating value and improving the cash flow performance of the business.

How much easier would it be to make business decisions if you knew how effective the changes would be before you made the decision?

Our next blog on Fiscal Focus will discuss how this thinking can be used to validate decisions using the simple yet powerful “Should We? Can We?” decision validation technique. You can view our Scenario Builder here!

Want to know more? Then contact us – its easy

Should We? / Can We? Scenario Builder

After many requests for a demonstration of the ‘Should We? / Can We? Scenario Builder’, we have now published a screencast for you to view.

To learn more about this powerful tool, start the Subscription process …. (don’t worry – it’s free to start!)

Stay Connected

Find out how much value you're creating by subscribing now.

Recent Posts

- ‘COVID-Zero’: Can We Afford It?

- Economics After COVID: Boom, Bust, or Something In-Between?

- Voodoo Finance For Sick Markets: Stock Prices During COVID-19

- Modern Monetary Theory

- Financial Forecasting – Introducing a Powerful New Module of the RealTime CEO Software

Categories

- Fiscal Focus (2)