Economics After COVID: Boom, Bust, or Something In-Between?

By Alasdair Cannon

Executive Summary

- In 2021, we hope that the end of the pandemic will come. But what will our post-pandemic economies look like? A few scenarios are possible.

- Boom: Some believe that savings accumulated during 2020’s lockdown will fuel a boom, as pent-up demand is unleashed on the economy.

- Bust: But there is also a chance of a debt-crisis once loan moratoriums end.

- Politics: Long-term recovery depends on our politics – we must change the policies that led to a low-growth, low-investment environment even before the pandemic.

- If business and government take the right actions now, there is reason to hope for a better future.

I. After the Pandemic…

In March 2021, the pandemic’s end seems tantalisingly close. An unprecedented vaccine was created with miraculous speed, and now governments worldwide are inoculating their populations against the COVID-19 virus. With continued fortune and perseverance, lockdowns and quarantines will soon be a thing of the past, along with their economically disastrous restrictions on human freedom.

This is good news. Nonetheless, it isn’t clear what kind of world we will return to once we can freely leave our homes again. Economists like Joseph Stiglitz fret over the ‘long-term scarring’ our economies have suffered during lockdown. His worries are justified: most signs point towards an almost inconceivable level of damage whose long-term effects are obscure. In 2020, the UK suffered its worst recession in over 300 years. The UK’s GDP fell by 9.9% last year, a fall whose magnitude is unmatched in any crisis since the Great Frost of 1709, a winter so cold that waterways and trade routes froze, and tree trunks shattered where they stood.[i] COVID-19 gave the world and the UK a dark winter, the true consequences of which won’t be understood for years to come.

Elsewhere, though, there are signs that an economic boom may occur once the virus is controlled. Some people argue that the savings accumulated during the pandemic could be converted into a rush of economic activity that will stimulate the economy back into prosperity. There is weight to this hypothesis: a large surge in consumer demand caused a ‘global supply chain crunch’[ii] in February this year, forcing Australian exporters to scramble for scarce shipping containers.

As the vaccine is administered, we hope for the recovery of our health and our economies. Despite our hopes, the future remains ambiguous. Recovery, depression, stagnation – we simply don’t know what we’ll face once we contain the virus. Of course, we cannot eliminate this ambiguity any more than we can see the future before it arrives. But we can try to understand it. Doing so is imperative if we want to coordinate our economic activities over the coming months and years. Thus, we must try to grasp the opportunities and threats that could arise in our post-COVID world while considering how these can be turned into long-term gains. Such is the only way towards a reasonable hope, after all.

II. Boom: Pent-Up Demand

Recently, commentators have proposed a scenario that could lead to a hopeful future after COVID-19: the release of consumers’ ‘pent-up demand’. The New York Times ran an article on February 21st that epitomised this notion, entitled ‘On the Post-Pandemic Horizon, Could That Be… a Boom?’[iii] There, the Times argued that an economic boom could occur when lockdown ends, as people spend the ‘trillion-dollar mound of cash’ accumulated during quarantine as a ‘result of lockdown-induced saving and successive rounds of stimulus payments’. They hope that money unspent last year will be spent this year, that 2020’s ‘pent-up demand’ will be unleashed in 2021, causing a ‘supercharged’ economic recovery and ‘years of stronger growth’.

Not often discussed, ‘pent-up’ demand is a simple and intuitive concept. During a lockdown, people are unable to spend their money in the ways they ordinarily would. They are also deprived of outlets for their usual consumer desires. Unable to travel, eat at restaurants, or visit cinemas, people who keep their jobs save money at an above-normal rate, while their desire for various goods and services becomes ‘pent up’.

A lockdown thereby creates a unique situation: repressed consumer wishes are combined with an abundance of cash. So, when the lockdown is lifted and people embrace their restored freedom, they rush back into the economy, spending their excess savings on the pleasures they missed. The demand ‘pent-up’ during lockdown is thus unleashed on the economy. Consumption spending, business activity and economic growth suddenly increase.

There are historical precedents for this kind of consumer behaviour. NPR’s Planet Money recently described how attendance at American baseball games plummeted in 1918, as the Spanish Flu broke out towards the end of WWI. When the war ended, and the pandemic had mostly cleared, attendance skyrocketed. 6,532,439 people went to a baseball game in 1919, more than double the number for 1918.[iv] This dynamic from the end of the 1910s is exactly what people forecast for the end of the COVID-19 pandemic, where US savings rates reached an all-time high of almost 26%.[v]

As the shortage of shipping containers mentioned before shows, pent-up demand is being released right now. While shortages are undesirable and can cause price inflation, we can rightly read this as a sign of recovery. Though it is too early to determine its extent, a revival of economic activity is underway as consumers spend their accumulated savings.

With pent-up demand, new opportunities for prosperity are therefore emerging right now. This is a cause for optimism: however, we must temper our fledgling hope with a few caveats.

First, we can’t expect that all of 2020’s deferred demand will become spending in 2021. In all likelihood, some fraction of 2020’s demand has been irrevocably lost. Time has passed and wants have waned. Compounding this is the natural hesitation that descends on an economy after a crisis. There are so many uncertainties at the moment – How effective are the vaccines? Will the virus mutate? Will we return to lockdown? Is another crisis coming? – that people will probably save this money to insure against future adversities.

Beyond this, we must remember that the direct gains from pent-up demand may only be temporary. At most, people will be able to spend a small portion of a year’s income in their post-lockdown rush. There is also no reason that the release of pent-up demand will cause a permanent increase in rates of consumption spending. If anything, people are likely to remain more conservative than before due to the prevailing economic uncertainty and will reduce their spending once their pent-up demand is exhausted.

Allowing the gains from pent-up demand to vanish in this way would be a waste. But if we want the gains to be permanent, pent-up demand must be directed towards the right ends. Funnelled towards industries and projects where profitable, long-term investment opportunities exist, the eruption of post-pandemic demand will support these investments and the jobs they create.

Pent-up demand is not a panacea for the COVID crisis, but it is an opportunity. Used properly, it could be a platform for long-term prosperity, growth and recovery. Spent on short-term opportunities, the macroeconomic improvements will be similarly short-lived. Policymakers and business leaders should act appropriately to ensure a slow-burn over a flash in the pan, as only the former will restore us to prosperity.

III Bust: Debt Crisis?

Against the opportunities implied by pent-up demand is the looming threat of a debt crisis.

In a remarkable moment in the pandemic’s early days, governments worldwide declared moratoriums and forbearances on debt repayments. Australians and Americans, among others, were relieved of their obligations to various debts, like mortgages and student loans, while landlords were banned from evicting their tenants in both countries. Of course, this protected the vulnerable from the ravages of a conjoined health and economic crisis. But these measures also contributed to the high saving rates observed during lockdown, and allowed income to be repurposed for consumption spending, helping stimulate the economy.

The moratoriums were an admirable and necessary action. However, they were always destined to be temporary. In Australia, many of these protections have already ended. Moratoriums on evictions remain only in South Australia and Victoria but will conclude in March 2021,[vi] and debt repayment provisions expired last year. And Americans will gradually lose their protections between March and September 2021.[vii]

Soon, banks will demand payments from their customers once more. Depending on the state of the economy – especially whether the indebted have returned to work and/or have enough savings to cover their loan commitments – this demand could quickly become catastrophic. If people in indebted households are still unable to work, restarting debt obligations will strain their savings. Aside from dampening their ability to stimulate the economy and unleash their pent-up demand, it could force them into insolvency and vagrancy. If enough people are pushed to this extreme, aggregate demand will fall while banks will be hit with large losses. End the moratoriums too soon, then, and we could provoke a debt crisis and an economic recession at once.

It is impossible to say whether a catastrophe like this will occur in 2021. However, the data suggest a growing vulnerability. In the USA, mortgage delinquency rates across all loan types increased substantially through 2020.[viii] Meanwhile, total US household debt reached an all-time high of $14.6tn by the end of last year.[ix] In Australia, the household debt-to-income ratio remains historically high.[x] And in both countries, the unemployment and underemployment rates are still elevated. While these variables aren’t conclusive, the government must be careful when revoking these measures. We do not need to add a financial crisis to our existing problems.

IV The Long-Term: An Opportunity to Improve?

Pent-up demand and the possible debt crisis are short-term issues: they will probably come to a head within the next year or two. Of equal or greater importance, however, are the longer-term systemic issues that the COVID crisis has brought to light. Like those already discussed, these also present causes for optimism and caution.

Nobody would deny that COVID-19 has brought destruction to economies around the world. Our human capital stock has been damaged through death and educational disruption, and the long-term effects of this will be significant. Nonetheless, like a cleansing fire, COVID-19 has also cleared the way for growth and improvements in our economies. Many businesses have closed, but we have gained the space to create new and better businesses in their place. And when we started working from home during lockdown, we improved workplace communications technology and discarded inefficient and outmoded norms about our workplaces. The need to commute to work has been eliminated for people worldwide, reducing noise, traffic, and pollution in our cities, while freeing up more time for productive work and leisure for workers. Make no mistake: this is a significant economic transformation that will reshape our societies for years to come.

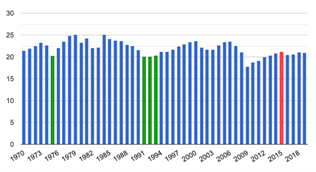

The COVID-19 crisis also presents an impetus and opportunity for reforming our wider economic paradigm. Advanced economies around the world were not thriving before COVID arrived. As the World Bank reports, the ‘global economy headed into the COVID-19 pandemic on the heels of a decade of slowing productivity growth and weak investment.’ Their research found that by 2018, labour productivity growth in advanced economies had slowed to 0.8% from 1.0% between 2000-09. And in 2019, investment growth had fallen below its 2000-09 average in two-thirds of the world’s economies.[xi] The situation in the USA is particularly unimpressive. Despite talks of a ‘strong economy’ in recent years, the best year for capital investment after the GFC was worse than all but four years between 1970 and 2008 (See Chart 1).

Around the world, there is a problem with investment. Yet it was not caused by an insufficient level of savings or liquidity but an unwillingness to invest. Before COVID-19, confidence in real economic investment had evaporated. This should be no surprise, for the COVID crisis is our third major economic downturn since the year 2000. It was also a threat that was predictable and possibly preventable but which nonetheless caught our governments off-guard, causing dramatic variations in responses from country to country. Business investment cannot thrive where instability prevails. Capitalism has decelerated and stagnated in recent years because our economic systems have become startlingly fragile and vulnerable.

Crucially, the repeated collapses and overall economic slowdown are not anomalies: they are signs of structural weaknesses. The neoliberal reliance on deregulated markets and our successive rounds of financial market support through bailouts and quantitative easing has led to a toxic situation: repeated crises have destroyed business confidence and forced interest rates to their all-time low, while financial markets have boomed due to government interventions. Thus, it has become rational for people to substitute away from real economic investment towards investment in shares: the returns to shares are larger and more secure.

The consequence of this, however, is an acceleration of share market growth coupled with a slowdown in real economic growth, which worsens with every new crisis, bailout and rate cut. This situation prevails in the US today. Between 2010 and 2020, nominal US GDP increased by roughly 40%,[xii] while the S&P500 index increased by nearly 200%. Stocks or the real economy: as an investor, where would you have put your money? Between the GFC and the COVID-19 crisis, the rational investor would have chosen stocks.

If we want our societies to recover and thrive after the COVID crisis – that is, if we want to rebuild our economies so they have higher GDP growth, more jobs, and better wages – we must commit to a course of action that supports real business investment and aggregate demand. We must use this as an opportunity to improve. Thus, we should support business investment in profitable projects that grow the real economy. These will create jobs, further supporting incomes, aggregate demand and continued investment in the future. Incentives for people to shift money from financial markets into the real economy are also necessary. At present, too much capital is tied up in non-productive investment: if we want a strong recovery, this money must enter the real economy. Likewise, if we support aggregate demand, businesses are more likely to invest because they can rationally expect greater profitability. To this end, policies to ensure that recovery is spread across high-income and low-income households are necessary, as are policies that encourage spending and stimulus throughout the economy.

Chart 1: USA Capital Investment as % of GDP, 1970 – 2019.

Source: https://www.theglobaleconomy.com/usa/capital_investment/

V On The Brink of the Future

Today, as always, we stand on the brink of the future. But our view is not clear. In the post-COVID world, the chance for prosperity mingles with the threat of new disasters. Tomorrow, we could have a vital and booming economy, or we could face stagnation or deep depression.

What happens next depends on our political and economic decisions. But it will also be shaped our attitudes toward the future. If we want our economic possibilities to be more hopeful, a collective optimism must prevail between businesses, individuals and governments today. The investments and actions needed for long-term prosperity will not otherwise occur. In pessimism, however, our future will necessarily become bleaker.

Against the catastrophe of 2020, a realistic and hopeful perspective is as necessary as pragmatic and efficient actions. At all levels, we must make efforts to foster a legitimate hope. Informed, optimistic beliefs will direct our actions towards the better future that we, those in the wake of disaster, so desperately crave. Our task, then, begins by understanding our situation, and all the risks and opportunities of our transformed world. It ends with effective, productive actions and a hopeful perspective: with views and decisions that reinforce one another for the better.

Endnotes

[i] See https://www.barrons.com/articles/u-k-is-headed-for-worst-recession-since-great-frost-of-1709-51588884310

[ii] See https://www.abc.net.au/news/rural/2021-02-01/food-shipping-container-shortage-puts-squeeze-on-trade/13100728

[iii] See https://www.nytimes.com/2021/02/21/business/economy/pandemic-economic-boom.html?action=click&module=Top%20Stories&pgtype=Homepage

[iv] See https://www.npr.org/sections/money/2021/01/12/955617983/what-1919-teaches-us-about-pent-up-demand

[v] See Joseph Stiglitz’s report, ‘The Economy of Tomorrow: Recovering and Restructuring After COVID-19’ at https://rooseveltinstitute.org/wp-content/uploads/2020/10/RI_-RecoveringandStructuringAfterCOVID19_IssueBrief_202010.pdf

[vi] See https://www.theguardian.com/australia-news/2020/nov/25/australias-rent-bomb-risk-means-countless-renters-could-face-eviction and https://ndh.org.au/debt-problems/housing/covid-19-changes-home-loans/

[vii] See https://www.cnbc.com/2021/01/20/biden-to-extend-the-national-ban-on-evictions-through-march-2021.html; https://www.whitehouse.gov/briefing-room/statements-releases/2021/02/16/fact-sheet-biden-administration-announces-extension-of-covid-19-forbearance-and-foreclosure-protections-for-homeowners/; and https://studentaid.gov/announcements-events/coronavirus

[viii] See https://www.newyorkfed.org/microeconomics/hhdc

[ix] See https://www.statista.com/chart/19955/household-debt-balance-in-the-united-states/

[x] See https://www.rba.gov.au/chart-pack/household-sector.html

[xi] See p.115 of their January 2021 ‘Global Economic Prospects’ report.

[xii] Real GDP increased by approximately 18% over the same period. Stats are sourced from the Bureau of Economic Analysis’ National Data. See https://apps.bea.gov/iTable/index_nipa.cfm

How much is invested in your business?

A common question that can cause unnecessary confusion for business owners is “How much is invested in your business?”. The same business owner can typically tell me approximately what their house is worth or how much they have invested in their share portfolio but they struggle to confirm how much is invested in their business. This is a problem, because it is very difficult to understand how much return you are generating if you don’t know how much is invested. So why is this so difficult? The answer lies in the traditional balance sheet which is not presented in a way that is easy to interpret and certainly does not readily tell us how much is invested in the business.

Have a look at this short screen cast for some insight to how the executives of DuPont addressed this issue over 90 years ago. Their insights have become common practice in public companies around the world but are still not understood by most private companies.

Unlocking the Power of Your Balance Sheet

Do you understand the power of the information contained in your balance sheet?

It may sound like a silly question, but your answer depends on your viewpoint. I typically hear midmarket CEOs and CFOs say (or think) one of the following:

- What power? We don’t even use the balance sheet. Cash flow and the P&L are the only statements we need. Cash is king.

- This guy is silly. We run the balance sheet every month and review the assets, liabilities and equity.

- Of course. We create the standard balance sheet because we’re required to, but we follow the DuPont model (just like every other public company in the world) to recast our receivables, inventory, fixed assets and payables to determine how much is invested in our business and how well our managers are performing to produce a return for our ownership.

Which bucket do you fall into?

Cash is king, so most entrepreneurs and small business owners fall into bucket #1. And, most public companies and large private companies fall into bucket #3.

But I see mid-market companies falling into all three buckets.

Sometimes, I even hear their accountants tell me that you can’t forecast the balance sheet into the future. And you shouldn’t change your balance sheet, because you must adhere to GAAP!

I don’t mean to be critical, but if you fall into bucket #1 or bucket #2, and have interest in learning about the more sophisticated methods for unlocking the value in your business, they’re available. Would it be valuable for you to understand, in real time, how much value you’re creating in your business, and how that will change in the future by the decisions you make today?

We’ve been doing this directly with clients for over a decade. And coming in May, we’ll have a new web app that will allow small to midmarket companies to move into bucket #3 by following a few simple procedures.

You can learn more and RSVP here.

(And if you want to explore the DuPont analysis, you can do so here.)

RealTime CEO Cash Flow

Fiscal Focus is the plain English measurement module of RealTimeCEO. In our Fiscal Focus blog we looked at the Fiscal Focus pyramid, which describes the two main business aims: to generate return and to generate cash flow. In this blog we will discuss cash flow, which is the lifeblood of your business. Some people say to me, “Cash flow’s fine, Nick, but what about profit? That’s what really important.” Well, let me put this analogy to you. Profit is like food to business, which is important. But cash flow is like oxygen. You can go without food for a while but how long can you go without oxygen?

So, if we accept that cash flow is vitally important, let’s look at an easy way to measure our cash flow. Each of the eight Fiscal Focus levers [insert link here] is going to either put pressure on your cash flow or take the pressure off. For example, if your suppliers will give you goods today which you don’t have to pay for until later, that will ease the pressure on your cash flow. Alternatively, if you provide goods to your customers today that they don’t pay for until later, that’s going to put pressure on your cash flow.

So, how do we measure the cash flow in our business?

Have a look at this video for more insight into Cash Flow.

Tracking cash flow using this method has two advantages: one, it’s a very easy way to track it; and two, it gives you specific information you will need in conversations with your bank. But this calculation is most powerful when done over a twelve-month period; don’t fall into the trap of tracking it on a year to date or part-year basis.

Having problems keeping track of your cash flow? Are you worried about the possibility of liquidity problems? We can provide you with all the information you need to measure your cash flow and show you ways to increase it. For more information, check out our app (coming soon on the home page).

You can also follow RealTimeCEO on Twitter or Facebook for updates on blogs and news items.

Tweet

Core Management Principle 3 – the ‘Crystal Ball’

Welcome back to our series of blogs on Core Managment Principles. We have already looked at ‘3W Accountability’ and this one discusses ‘Decision Validation’ or what we call the RealTimeCEO Crystal Ball.

“An expert is somebody who has managed to make decisions and judgements simpler by knowing what to pay attention to and what to ignore.”

– Edward de Bono.

Don’t you wish you had a Crystal Ball?

Making decisions is a vital part of a CEO’s job. By knowing how to separate the important impacts from the other impacts, you will make a better decision. But how can you possibly make a decision about the future using data from the past? There may be other factors, for example, political or emotional considerations. Have you ever found yourself with a decision to make that has outdated, incomplete or inaccurate data, with political and/or emotional overtones? You probably relied on the thing which has got you where you are today – gut feel. We’re not saying gut feel isn’t important, but it does occasionally send you down the wrong path and it can be tough to get back from there. You need a Crystal Ball, right? Our process works with your instincts by helping you to test them.

For every decision, you need to ask two questions:

- Should we do this?

- Can we do this?

The Should We? question can be answered by looking at Return on Operations (ROO). If the result of your decision makes your ROO stronger, then your reason for being will be stronger and you should do it. If the decision will result in your ROO being diminished, then you shouldn’t. For more information about ROO see our blog, RealTime CEO / Fiscal Focus – Return.

The Can We? question depends on what it will do to your business’s cash flow. Do you have enough cash flow to fund this decision without jeopardizing your future cash flow? If the answer is yes, then you can. If the answer is no, then you can’t. For more information on cash flow refer to our blog, RealTime CEO / Fiscal Focus – Cash Flow.

Should we/Can we? brings clarity to decisions that may have been hazy in the past. In other words it gives you a Crystal Ball.

If you would like further clarity on this subject or any of our other tools, check out our app on our home page.

Forecasting the Future – Alternatives

Forecasting the future relies on an accurate method of measuring past and current performance. As the year progresses, everything is compared back to the figures provided at the beginning of the year. Many businesses operate this way mainly because that’s the way they’ve always done it. This limits your view to the number of months that have passed since the start of the year and may cause trends to be missed. The YTD method does have value when you need to estimate tax but leave that to the accountants; RealTime CEOs need a more effective method of forecasting everything else.

What if you could always have a complete set of data for twelve months or twenty-four months, no matter what time of the year it is? In our blog 24 Month Rolling Forecasts, we discussed the Trailing Twelve Month method of measuring your business’s performance. This method gives a twelve-month view of your business at any given time. As one month drops off, another month adds on. But what if we could look even further ahead?

Imagine you’re driving along the freeway in a shiny, new sports car… Research tells us that we maintain a field of vision of about 120 metres in front of us. What happens in that field of vision helps you make decisions while driving your car. Now, we don’t just keep looking ahead to the same spot, otherwise we’d end up looking at the front of our car, which would be really dangerous. Instead we keep looking ahead in that field of vision. This is what we want to do when we measure business performance. When you look ahead to the end of the year, the distance is shrinking as you get closer to it. What we want to do is maintain your field of vision ahead of your business.

We can better accomplish this with RealTime 24-Month Rolling Forecasts. In our next blog, we’ll examine the mechanics of RealTime 24-Month Rolling forecast. You can also contact us for a plan that’s tailored to your business.

The 4 Business Quadrants – Your Market

In our previous blog “The 4 Business Quadrants”, the second quadrant is called “Your Market” and is defined by the relatively simple question “Who are your Customers?”.

Defining Your Market

Defining your customers is often easier than deciding how you will identify, attract and interact with them. There are many components to these questions but 2 key elements are

(i) the definition of your market and your marketing strategy and

(ii) the definition of your sales tactics.

The terms sales and marketing are often grouped together, so often that we can hear them as one word, salesandmarketing. They are actually two very different functions. One is tactical; one is strategic. The sales function is tactical, where you identify a prospect, qualify that prospect and close the deal. The marketing function is strategic; it raises awareness and increases the possibility of people wanting to do business with you.

Successful companies have learned that it is logical and productive to put the strategic before the tactical, in other words, have your strategy in place before implementing the tactics to achieve that strategy. Large companies spend millions of dollars on marketing strategies to evaluate their market BEFORE they try to sell their product.

In contrast, most midmarket companies have a tiny marketing division tucked at the bottom of the sales team. These companies have put the tactical before the strategic and often pay a handsome price for this mistake.

Once you have defined your marketing strategy and sales tactics, challenge yourself – are they complimentary? In tough times, sales teams often resort to the predictable conclusion “If I don’t drop my price I will lose the sale”. This behavior may not be consistent with your market reputation or your marketing strategy.

Sales people who don’t have a clear understanding of the marketing strategy or are not able to differentiate their offering from the competitors predictably find it easier to drop the price than to work hard at the real skills of selling. As will be identified in future blogs dropping prices can often be the quickest way to destroy value in your business.

Make sure you come back to read about the other areas of the 4 Business Quadrants – Your Foundation, Your Operations and Your People.

Want to now more? Then subscribe!

The 4 Business Quadrants

How is your Business Balance?

In our blog The Perfect Skill Mix of a CEO, we discussed the ideal attributes for business leaders. In this blog, we will look at the ideal skill mix for your whole business by looking at the 4 Business Quadrants.

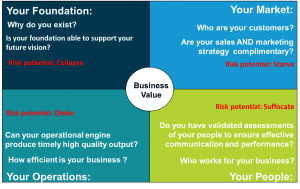

There are four business disciplines as detailed in the following graphic:

- Key Functions – Busines Quadrants

Your Foundation:

This is the reason your business exists. It provides motivation to combine your people and processes to create your products and services ready for delivery to your market.

Your Market:

This refers to your strategies to interact with your market, clients and customers that buy your product or service.

Your Operations:

The engine of your business, which includes the equipment, systems, procedures and supplies that enables your business to produce its product or service.

Your People:

The people who work in your business and help to create and deliver your product or service.

We will provide more information about each of these quadrants in future blogs.

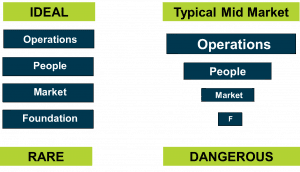

Business Balance:

In Fortune 500 companies, these quadrants are equally important and have huge resourcing levels. This is the ideal scenario because all four quadrants are vitally important. Sadly, this is not usually the case in midmarket companies, where the balance is heavily weighted towards operations and to a lesser extent, people. While you may be focused on sales, often your wider “market” strategies are thin. Unfortunately, little focus is applied to your business foundation.

Business Balance – Ideal vs Typical

Does your business need to invest more time and energy into your foundation and your market? Probably.

If your business has weaknesses in any of these areas, it puts you at risk of business failure. These areas even have their own methods of decline. Your business can collapse if your foundation isn’t strong enough. Your business can starve if your market strategies are ineffective. Your business can choke if your engine is not able to accelerate at the required rate. And if you have the wrong people, who are sucking the energy out of your business, it can suffocate.

But on a happier note, you now have the opportunity to avoid that by ensuring your business is solid all the way through. Come back and visit us again and we will elaborate more on each of the business quadrants and show you how to keep your business strong and healthy.

Want to know more? Check out all our simple tools for improving your business.

The new RealTime CEO website

Welcome to the new RealTime CEO website!

After 10 years of delivering Vistage and TEC workshops and providing tools and services under the Fiscal Focus brand, we decided to rebrand to better communicate the essence of what we represent to our market.

Our offering isn’t just a set of numbers for financially-minded CEOs of mid-market companies; it’s a set of software tools and support to allow you see what’s happening in your business right now, in real time, and in the future.

Though our brand is new, our software, support and tools have been validated in over 1,000 companies worldwide. They work for any company, in any industry, of any size, anywhere in the world.

If you like what you’re seeing, keep in touch. We’d love to hear from you.

Stay Connected

Find out how much value you're creating by subscribing now.

Recent Posts

- ‘COVID-Zero’: Can We Afford It?

- Economics After COVID: Boom, Bust, or Something In-Between?

- Voodoo Finance For Sick Markets: Stock Prices During COVID-19

- Modern Monetary Theory

- Financial Forecasting – Introducing a Powerful New Module of the RealTime CEO Software

Categories

- Fiscal Focus (2)