Mathematics of Pricing – The Impact of Price Increase or Price Discount

What would be the impact of price increase or price discount on your business? In this blog we’re going to look at your pricing strategy.

A lot of people tell me their businesses don’t set their own pricing; the market does that for them. This is not true in most cases. It is true to say that there are a small percentage of businesses that don’t have any control over their pricing. If you’re selling a product that is regulated by law, you have no control. If you’re selling homogenous commodities like gasoline/milk/wool, the world markets will set the price. Sometimes you may be selling to an 800-pound gorilla. Do you know where an 800-pound gorilla sits in the room? The answer is anywhere it wants to. If you’re selling to an 800-pound gorilla you get told what the price is, take it or leave it. But for the other 99 percent of businesses, you have control over your pricing.

Your contribution margin is how much of each dollar of sales is remaining after all variable costs are covered. It called a contribution margin because it is the component of the sales dollars that contributes to covering fixed costs and profit.

For example, if your contribution margin is 30% and you increase your price by 10%, if you lose exactly 25% of your volume margin you will generate exactly the same contribution margin in dollars. However if you discount your price by 10% you will need to increase your volume by 50% to generate the same contribution margin in dollars.

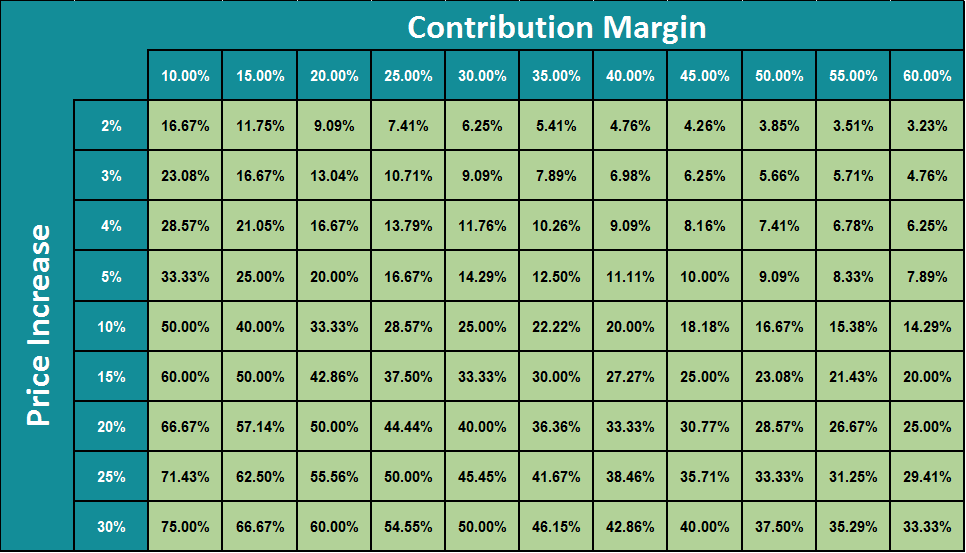

The Impact of Price Increase

After a Price Increase, what percentage drop in unit sales will result in the same $ Contribution Margin?

The impact of a Price Increase

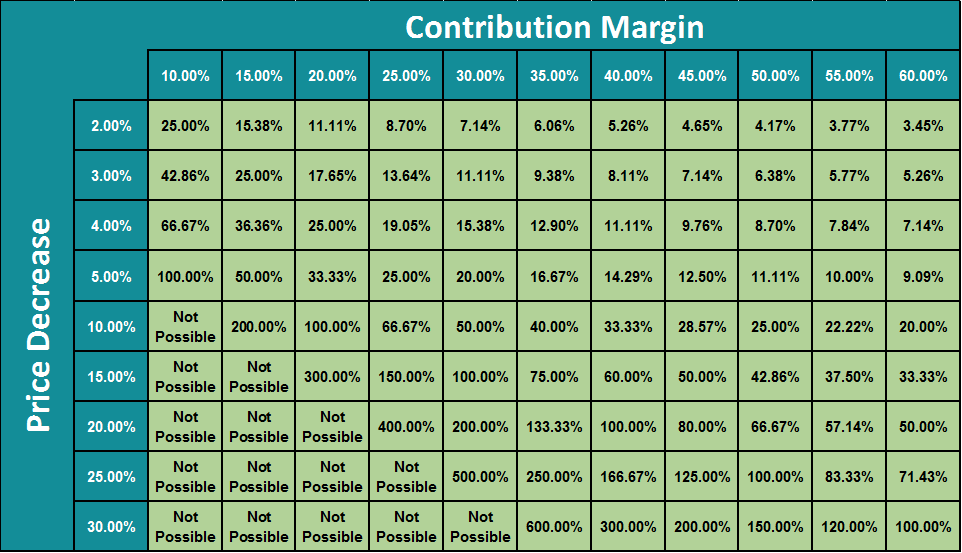

The Impact of Price Discount

After a Price Decrease, what percentage increase in unit sales will be necessary to result in the same $ Contribution Margin?

The Impact of a Price Discount

As you can see from this example, you need a bigger change in volume following a price discount. You have to work so much harder to catch up after a price decrease that it’s not worthwhile for the amount of return.

In our experience a price increase will benefit the business whereas a price discount will not. This is the opposite of conventional sales wisdom. The sales people are likely to be the ones in your business most vocally opposed to a price increase, in particular, your weakest sales people. Here’s a piece of advice –

“Don’t set your business strategies based on feedback from your weakest staff members.” – Nick Setchell.

If you want any more information on this or any of our other tools, just contact us!

Sensitivity Analysis

Sensitivity Analysis helps you decide which action will have the biggest impact on your business

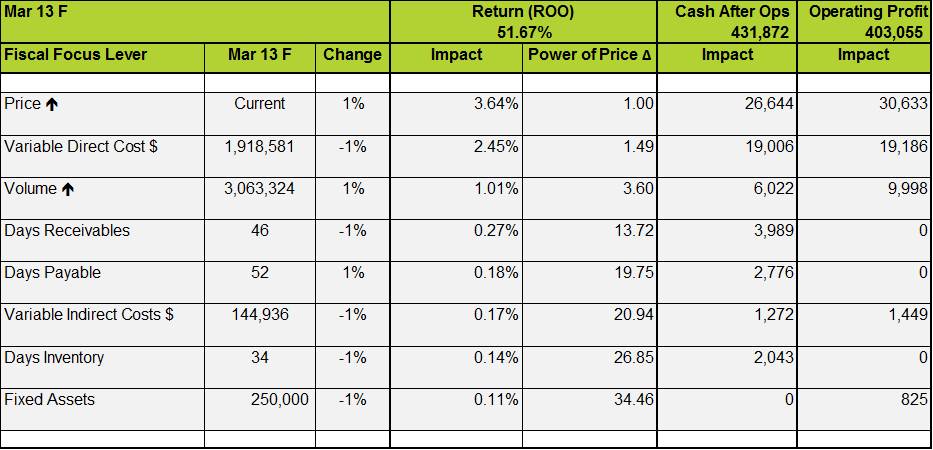

In our blog 3W Accountability we discussed how we hold people accountable for actions being completed. It’s all very well to decide what action you’re going to take but how do you ensure that you’re allocating your scarce resources in the most effective way? In this blog, we’re going to look at sensitivity analysis as a way of helping you decide which action will have the biggest impact. Sensitivity analysis enables you to determine which one percent change to any of those levers will have the most profound impact on the business’s strengths and weaknesses.

– Sensitivity analysis calculates the impact of changes to each RealTime lever

– Highlights areas of high impact – inevitably price

– Also highlights areas of low impact – inevitably variable indirect costs.

In the diagram above we demonstrate how a one percent change to each of eight Fiscal Focus levers will impact your profit. Fiscal Focus levers are things that executives can change in order to influence the performance of the business. As you can see, the lever that has the biggest impact is price. But it’s interesting to note that variable indirect costs has a lower impact than many other levers, something to think about if cost-cutting is one of your main strategies.

Sensitivity analysis shows you how to allocate your resources

Sensitivity analysis shows you how to allocate your scarce resources to where they’re going to have the biggest impact. An analysis of your business will clearly show what is most effective at creating value and improving your performance. How much easier would it be to make business decisions if you knew how effective the changes would be before you made the decision?

Contact us on how to get specific information on a sensitivity analysis for your business.

Join us again next time as we look at the Mathematics of Pricing. (This one may surprise you! 😯 )

The 4 Business Quadrants – Your Operations

Your operations are the engine of your business.

This includes equipment, systems, procedures and supplies. All of these enable your business to produce its product or service.

The next two years will bring rapid change, which creates opportunity and potential growth. Traveling around the US, we consistently hear growth forecasts of up to thirty percent in the next twelve months. How exciting! But consider this question first – how well equipped is your business engine to seize these opportunities?

When the financial crisis happened, the operations of businesses changed. The first indicator was the increase in the number of days for Accounts Receivable. It was an early warning sign of tough times ahead. Next, there were pricing pressures, initially called downsizing, later changed to rightsizing as the operations became leaner. The engine you now find has lean capacity, tight pricing and with Accounts Receivable higher than they should be. And this is the engine you’re going to ask to grow by thirty percent?

“Now, let me introduce another concept, the second wave of bankruptcy.

It’s a sad fact that many businesses went under during the financial crisis. As sad as that is, maybe it needed to happen. The poor performers are weeded out and the strong ones remain to grab the opportunities in the improving economy. But not all businesses that survived the first wave of bankruptcy will survive the next two years.” – Nick Setchell

Consider the capacity of your engine when making your growth forecasts. It’s much better to grow by twelve to fifteen percent with a sensible pricing strategy, than by thirty to forty percent with a foolish pricing strategy. A business with the latter is a candidate for bankruptcy. It’s going to happen to many businesses, so be sure it doesn’t happen to yours.

‘Your Operations’ is the final of the 4 Business Quadrants. Feel free to go back and read about the other quadrants – Your Foundation, Your Market and Your People

Join us for our next series of blogs on Core Management Principles. The first one will look at what I call ‘3W Accountability’. If you want to more, contact us to have a chat with Nick Setchell.

Celebration Culture

Welcome back to our readers! In our last blog Your People, we discussed the important role your staff play in your business. Today we will be looking at ways to boost morale among your staff by creating a celebration culture.

Create a Celebration Culture in your business

Why have a Celebration Culture

It’s important to celebrate regularly in your business. People respond well to positive stimulation. But when times are tough, it’s easy to get caught up in negativity and forget about celebrations. This mood filters through to all your people.

“But the tougher it gets out there, the more you have an opportunity to win. Let’s turn around that negative outlook and think about what we have to celebrate. What are we doing well? What are we proud of? What about the fact that we’re still here? You know who isn’t celebrating that? The people who are no longer in business. Well, we’re here and that’s worth celebrating.” – Nick Setchell

How to create a Celebration Culture

Find something you can celebrate each week. If someone wins an award or delivers an outstanding customer experience, there’s a great reason to call it out and generate pride in the business. Celebrations don’t have to be expensive or on a large scale. Ideas can include recognizing achievements in meetings, providing morning tea, issuing small mementos such as pens or coffee mugs with positive messages or hosting a lunchtime/after work BBQ. Not only does this give your people an opportunity to gather in a more relaxed setting, it gives you as the CEO an opportunity to tell your people in person what a good job they’re doing.

If you’re the type of boss who doesn’t often praise your people for their achievements, creating reasons to celebrate will have a powerful positive effect on morale. And if you’re the type who constantly hammers your people to do better, it can have an even greater impact. If you just push your staff all the time, they will get used to it and will just stop listening. So it’s important to keep the right balance of encouraging your people to do better and celebrating their achievements.

Come back and join us for our next blog where we will be focusing on Your Operations and how well equipped your business engine is to seize growth opportunities.

Want to hear more about RealTime CEO and how it can help your business? Get in touch with us and organise a chat with Nick Setchell.

The 4 Business Quadrants – Your People

Your people are the people who work in your business. Their input allows your business to produce its product or service. ‘Your People’ is also the 3rd quadrant in the 4 Business Quadrants.

How do you know what kind of people you have working for your business? Do you have validated way of assessing whether your people are doing what you’ve asked them to do? I’m sure each of you has uttered those immortal words, “People are our greatest asset.” You may be right. If you are, then one of the most critical parts of your job, whether you like it or not, is to be a part time psychologist for your people. CEOs have many qualifications but a degree in psychology isn’t usually one of them. Most CEOs are not qualified to do one of the most important parts of their job. So, how do we manage the different skills and challenges of our staff members? The good news is that people assessment tools are more powerful and more readily available today.

How do we communicate with people in other areas of the business? People come together from different areas of the business but everyone has different skills & different areas or expertise. It helps if we can create a common vocabulary that enables everyone to participate. For example – in terms of plain English measurement of business performance, check out our blog on Fiscal Focus.

Unlike other business assets, it’s much harder to predict what is going to happen with people because human beings have free will and different people will respond to different management styles. Try to establish what makes your people tick and think about how you could vary your management style to get the best out of your people.

If people are our greatest asset then it’s important to keep them people happy. And it’s especially vital during tough times. In our next blog we will discuss Celebration Culture and how you can improve morale in your business.

Think you need some more advice in this area? Reach out to us and we can help you.

Dominant Competitive Advantage (DCA)

What is DCA

Those of our readers with sales experience will know about unique selling propositions (USP). They are the reason that one product or service is different from and better than that of the competition. Dominant Competitive Advantage (DCA) is to the whole of business what a USP is to a product or service. What is it about your business that is superior to your competition? Why should a potential customer deal with you above any other business?

Most midmarket companies don’t have a DCA. It’s surprising that when we ask this question more than fifty percent of the respondents think their DCA is customer service. This sounds good until we test it through the most stringent filter – is this something YOU can say that your competitors cannot? Are your competitors saying they provide good service? Probably! Whether they are or not is not really important – if you keep pushing your case on “customer service” your prospect will not be able to distinguish you from everyone else saying the same thing and then you will be forced to compete on price . Very few businesses want to end up here – only the biggest, deepest pocket player in the market will win this battle.

Does your DCA pass the test?

Your DCA is a powerful simple reason why your prospect should deal with you and not your competitor. Yes it is a strength of yours but it is more than that. Good DCA also pass these tests:

- Focused and simple

- Objective

- Quantifiable

- Self-centered

- Supported by stories

- And most importantly, not stated by competitors

Once you’ve found your DCA, build your business communications around that distinguishing factor. Every component of your communications should relate back to your DCA. Your website, advertising, proposals, bids, elevator speech and anything else that represents your business should all emphasise what makes YOUR business the best.

Finding your DCA is not easy but it is worth the investment. How do you find your DCA? Ask us. We are can help you distinguish your business from all of your competitors.

The 4 Business Quadrants – Your Market

In our previous blog “The 4 Business Quadrants”, the second quadrant is called “Your Market” and is defined by the relatively simple question “Who are your Customers?”.

Defining Your Market

Defining your customers is often easier than deciding how you will identify, attract and interact with them. There are many components to these questions but 2 key elements are

(i) the definition of your market and your marketing strategy and

(ii) the definition of your sales tactics.

The terms sales and marketing are often grouped together, so often that we can hear them as one word, salesandmarketing. They are actually two very different functions. One is tactical; one is strategic. The sales function is tactical, where you identify a prospect, qualify that prospect and close the deal. The marketing function is strategic; it raises awareness and increases the possibility of people wanting to do business with you.

Successful companies have learned that it is logical and productive to put the strategic before the tactical, in other words, have your strategy in place before implementing the tactics to achieve that strategy. Large companies spend millions of dollars on marketing strategies to evaluate their market BEFORE they try to sell their product.

In contrast, most midmarket companies have a tiny marketing division tucked at the bottom of the sales team. These companies have put the tactical before the strategic and often pay a handsome price for this mistake.

Once you have defined your marketing strategy and sales tactics, challenge yourself – are they complimentary? In tough times, sales teams often resort to the predictable conclusion “If I don’t drop my price I will lose the sale”. This behavior may not be consistent with your market reputation or your marketing strategy.

Sales people who don’t have a clear understanding of the marketing strategy or are not able to differentiate their offering from the competitors predictably find it easier to drop the price than to work hard at the real skills of selling. As will be identified in future blogs dropping prices can often be the quickest way to destroy value in your business.

Make sure you come back to read about the other areas of the 4 Business Quadrants – Your Foundation, Your Operations and Your People.

Want to now more? Then subscribe!

The 4 Business Quadrants – Your Foundation

In our introduction to The 4 Business Quadrants, you will see that the first quadrant is “Your Foundation”. The foundation of your business is your business’s reason for being.

Also, when we discussed Business Differences and Similarities , we noted that one of the things linking businesses around the world is that they all have a business foundation. Why does your business exist?

This sounds an easy question to answer until we establish the rule that you cannot answer it numerically. You do not exist to make profit, cash flow or money. These are the results of you doing what you do well.

Your business’s reason for being (or business foundation) is a deeper issue providing you with a compass to determine all other business strategies. If it is not well defined in your business, then all other strategies will be compromised.

How do you assess your business foundation?

One of the easiest ways to assess your business foundation is to ask a number of your staff members, “Why do we exist?” Once they have answered in a predictably numerical fashion, ask the question again explaining that you are seeking a non-numerical reason. If the next set of answers all follow a common theme, you have a strong foundation. However, if, as in most cases we have experienced, there is a huge variety, then your foundation is weak. Presented with this situation, I am sometimes tempted to ask if all the attendees who answered the questions work for the same business!

You may be surprised how powerful this simple exercise is. It can generate passionate and valuable conversations amongst your key employees as well as give you a clear understanding of their views of your business.

Once you’ve established your foundation, you need to communicate it clearly to your team. Everyone needs to know your foundation to be able to move forward together. The foundation needs to be the basis of your business culture. Make it an integral part of all your business disciplines: interaction with your market, interaction with your people (internal and external) and a guide for your procedures and operations.

To be able to steer your business in the right direction, you need to have an accurate compass and that compass is your foundation.

Is your business foundation able to support your future vision for for the business? Come back next time to hear about how your foundation plays into the interaction with your market.

Make sure you come back to read about the other areas of the 4 Business Quadrants – Your Market, Your Operations and Your People.

To find out more about how we can help your business, check out some of the tools available through RealTimeCEO.

Business Differences & Similarities

In our last blog, The Perfect Skill Mix of a CEO, we talked about differences among business leaders and the ideal mix of skills. As people are different, so too are businesses. At RealTime CEO we’ve assisted businesses all around the world. These businesses differ in:

- Industry – the type of industry in which the business is involved e.g. manufacturing, engineering, financial, hospitality, consultancy etc.

- Resources usage – some businesses are reliant on machinery; others rely more on people; others rely on technology.

- Commercial versus charity motivation – some businesses have a commercial, profit motivation; others have a charitable or not-for-profit motivation. (Note: Don’t get them mixed up and become a commercial, not-for-profit business. It’s not a good combination!)

- Capacity and constraints – some businesses have greater resources and can buy the best machinery or attract the best people.

But there are other things that all businesses have in common. They all:

- Use INPUT to create OUTPUT – businesses add value (either through production or people) to resources to create a product or service.

- Have foundation principles – your business foundation is the reason your business exists, why you do what you do (more about this in our next blog, Business Foundation).

- Utilise people – where would any business be without its people?

- Have operational functionality – including procedures that govern how to do something and standards against which the business is measured.

- Are seeking access to a market – obviously there needs to be a market for your particular product or service. Some business leaders are also able to influence their markets. RealTime CEO can help you do this.

At RealTime CEO we accept that businesses are different and we can accommodate the needs of your business. We also know the people in your business have different skills and backgrounds and don’t always understand the financial impact of their decisions.

If you’d like some information on teaching your people to speak the same “financial language”, check out our Fiscal Focus blog.

Want to know more? Subscribe Today!

What is the Perfect Skill Mix of a RealTime CEO?

Previously we have discussed J Curve Management and 24 Month Rolling but what makes a great RealTime CEO?

We encounter lots of exciting opportunities in our executive journey, which we can harness to great value in our business. But for all the opportunities we seize, we also face hurdles, challenges and frustrations, things that could hold us up – if we let them hold us up. How you choose to deal with those frustrations will define how successful you are as a CEO. Frustrations cause many people to lose sight of their goals, become negative and complain that it’s not fair. But if you’re one of those rare people who can look at almost any storm cloud and turn it into a positive, then you’re going to win in any scenario.

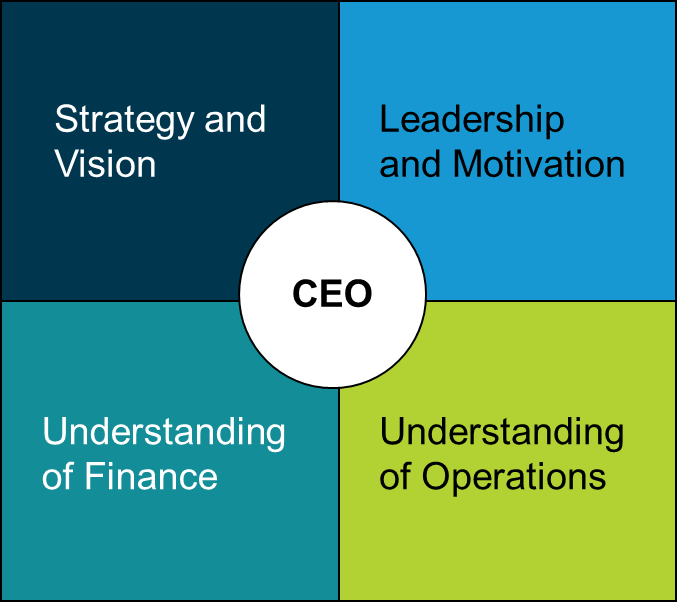

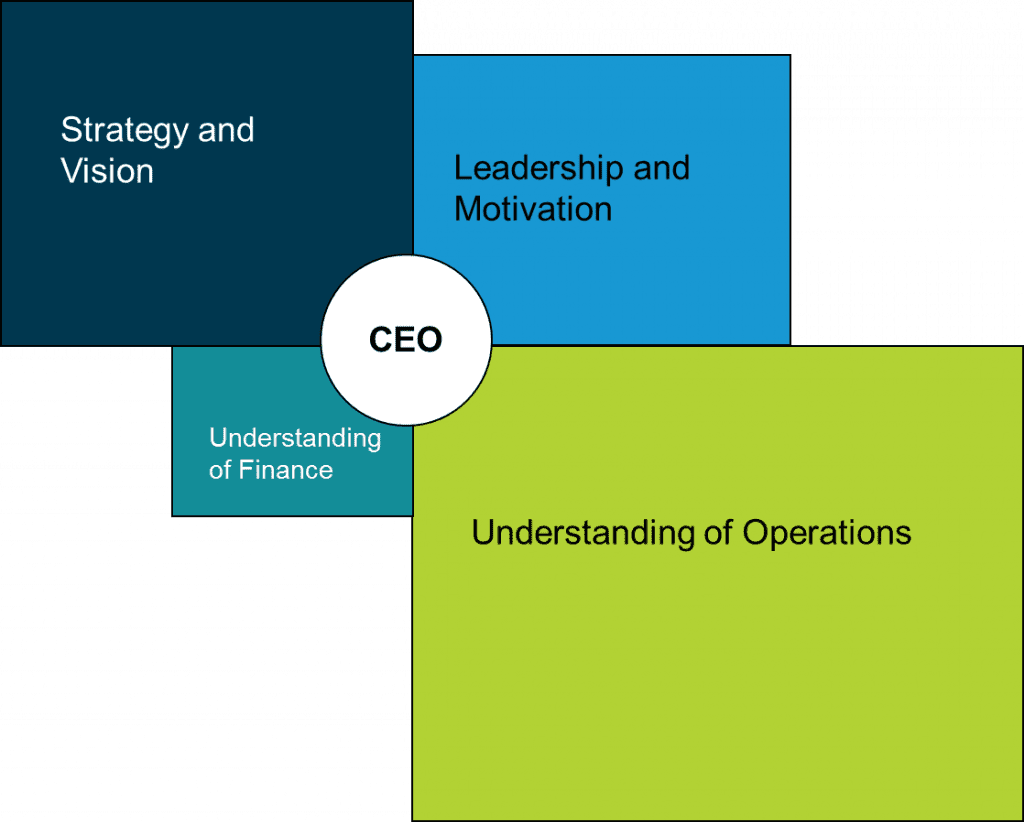

Being a successful CEO requires the ability to lift your eyes and look out over the horizon, as frequently as possible. This will enable you to define the journey and then plan the strategy and vision for your business. There will be a hundred good reasons why you can’t do this, the eighty things you have to do today and the twenty things you still haven’t done from yesterday. But if you don’t do this, you won’t succeed. Once you have your vision (and it will change every day because your landscape changes every day), you need to be able to share that vision with your people. You need to be good at what you do and you need to have a strong understanding of numbers and finance. The following graphic depicts the perfect skill mix of a RealTime CEO.

In most mid market companies, the CEO’s skills are not quite so balanced.

CEOs of midmarket companies are usually leaders because they’re good at what they do e.g. good architects, good builders, good technicians or sales people. The business builds up around them and one day, the founder becomes the CEO. So while the CEO is operationally very skilled, he or she is unlikely to have had any formal training in running a business. Businesses don’t usually fail because the CEO is not skilled at the original job, more often because there is a lack of understanding of the other key components: Strategy and Vision, Leadership and Motivation and Understanding of Finance.

Come back and visit RealTimeCEO again to see how you can learn from the past to influence the future.

Want to find out more? It is easy – just Subscribe!

Stay Connected

Find out how much value you're creating by subscribing now.

Recent Posts

- ‘COVID-Zero’: Can We Afford It?

- Economics After COVID: Boom, Bust, or Something In-Between?

- Voodoo Finance For Sick Markets: Stock Prices During COVID-19

- Modern Monetary Theory

- Financial Forecasting – Introducing a Powerful New Module of the RealTime CEO Software

Categories

- Fiscal Focus (2)